By Bill Hornbarger, Chief Investment Officer at Moneta (@MonetaCIO)

As we write this, the equity market is firmly in bear territory with the S&P 500 down 30% from its recent record close; volatility has spiked to levels not seen since the Global Financial Crisis (GFC) and, by some measures, the highest on record. The coronavirus has added the term social distancing to the common lexicon and business activity has slowed visibly and quickly. While recessions are dated in hindsight by the National Bureau of Economic Research (NBER), I don’t think anyone will be surprised if one is determined to have started on March 1 of this year.

When or whether a recession is declared, the markets have priced in a significant amount of bad news for the economy and a commonly asked question is, “How bad can it get?” For most of us, the best frame of reference is the 2007-2009 Global Financial Crisis (GFC) when the peak to trough decline in the S&P 500 was 57% and the economy suffered the “Great Recession,” which lasted 1 year and 6 months.

In the current environment, there are some similarities to conditions seen during the Great Financial Crisis (GFC). The markets are volatile and under pressure, concerns and uncertainty abound over how great the economic damage will be and there is a lack of liquidity in many sectors of the financial markets.

Policymakers were presented with a daunting challenge during the GFC. They were in a position of having to design the policies and programs necessary to cushion the economy and keep the markets working, determine an implementation plan, get Congressional approval and then enact them. In many cases, this took weeks or even months and several attempts. One of the signature programs of the response was the Troubled Asset Relief Program (better known as TARP), which was part of a bill that failed in the House the first time it was voted on.

The good news is that, due to the efforts of policymakers during the last recession, a number of policy tools are available to deal with the current market environment. Taking a page from the GFC “playbook,” policy makers have very quickly:

- Reduced the target Fed funds rate to 0% (lower bound)

- Launched quantitative easing ($700 billion of bond purchases)

- Activated the Commercial Paper Funding Facility

- Announced reinstatement of a Primary Dealer Credit Facility to free up credit

- Established a Money Market Mutual Fund Liquidity Facility

- Established dollar swaps with multiple foreign central banks

All these actions have happened in the span of 16 days. Will they be enough? Only time and history will tell us. By any measure, the response has been aggressive and policymakers have made it clear that they will do whatever is necessary to support the economy and markets during this time.

In closing, we will reiterate that one of the key characteristics of a good investor is to be resistant to panic and euphoria. The volatility and speed of the decline has been gut wrenching, but as has been noted previously, most of us have been through this before. The lesson from history is to take a long-term perspective, don’t make emotional decisions and realize that the economy and markets want to grow – these episodes are periodically part of that experience.

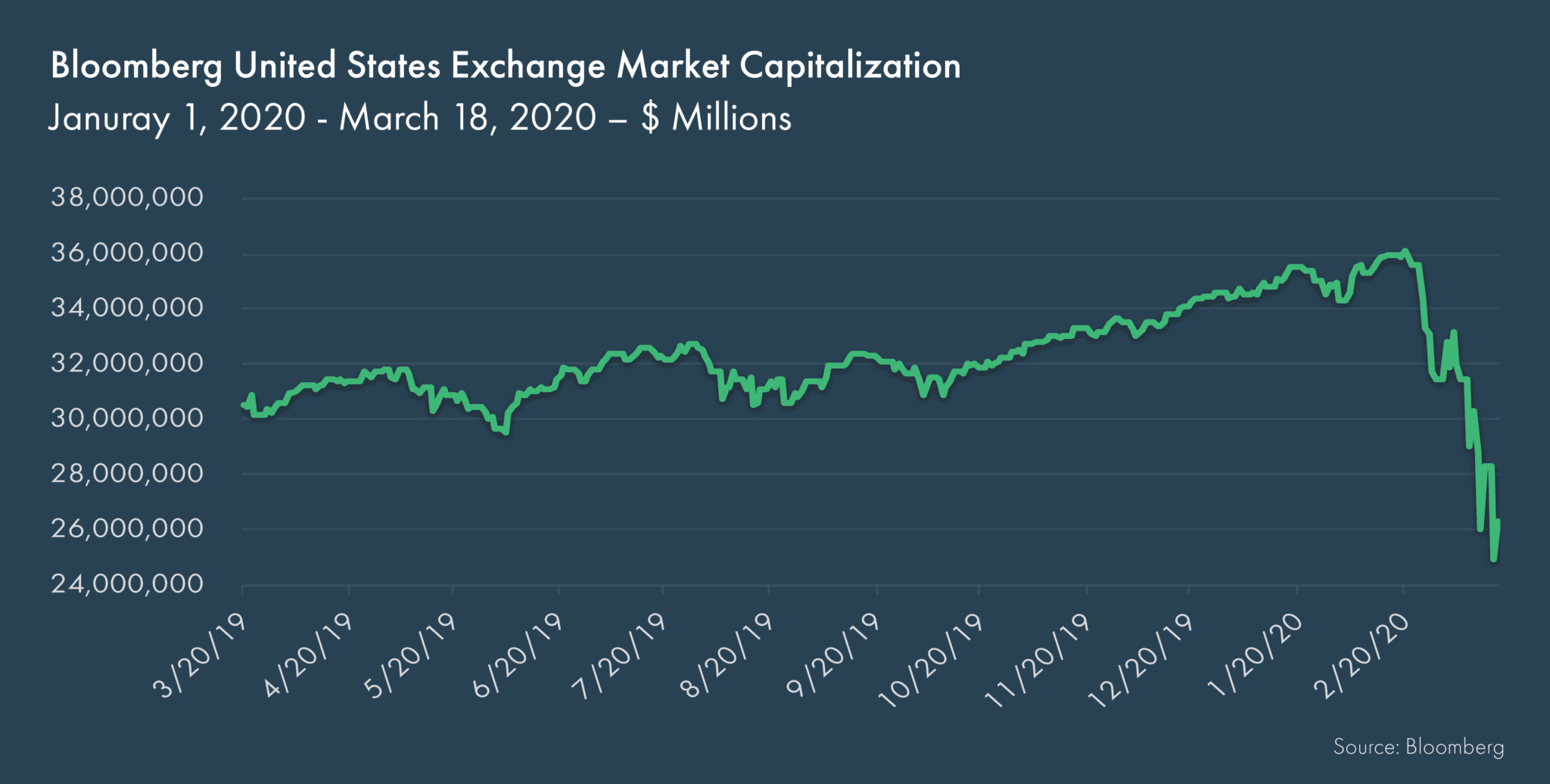

The following chart illustrates the decline in U.S. market capitalization, which has been approximately $10 trillion in a month. When compared to an economy that has nominal GDP valued at $21.7 trillion, it appears that many investors have reacted emotionally.

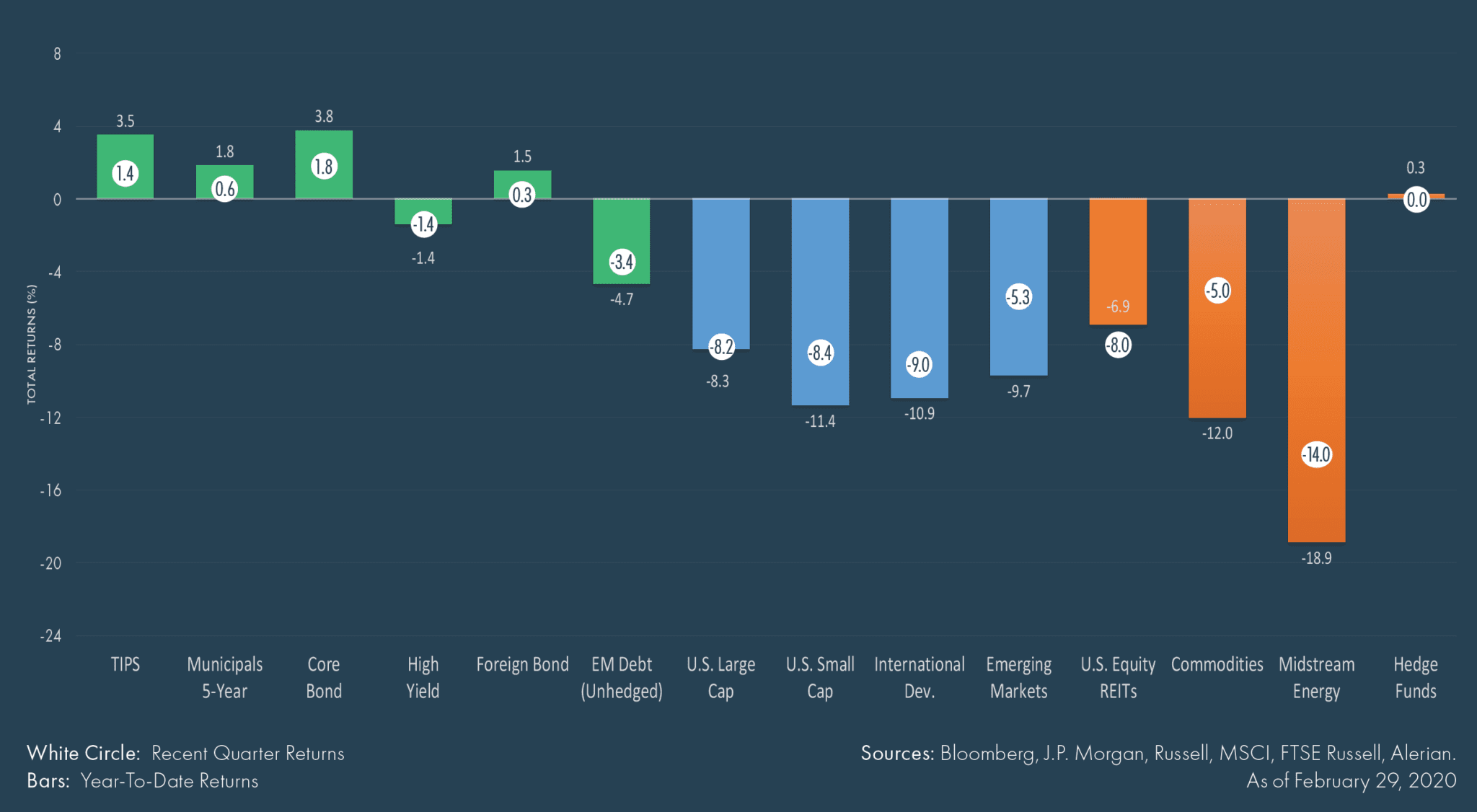

Asset Class Performance

Fixed Income

+ Flight to quality more than offsets widening credit spreads amid a backdrop of elevated volatility.

+ Falling global interest rates.

– Safe haven flows detracted from lower quality and international.

Equities

– Elevated uncertainty associated with coronavirus outbreaks weighed on business activity and investor sentiment.

– 71% of S&P 500 Index companies reported a positive earnings surprise on lowered consensus estimates, butaverage index earnings grew just 0.7%.

Alternatives

– Slowdown in business activity weighed on energy and industrial commodity sector-sensitive asset classes.

– Despite falling yields, risk-off sentiment detracted from U.S. REIT returns.

Financial Market Performance

For the latest on the coronavirus’ impact on the markets, visit Bill Hornbarger’s Twitter feed @MonetaCIO and our firm’s main account @Moneta.

© 2020 Moneta Group Investment Advisors, LLC. All rights reserved. These materials were prepared for informational purposes only based on materials deemed reliable, but the accuracy of which has not been verified. This is not an offer to sell or buy securities. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. Past performance is not indicative of future returns. These materials do not take into consideration your personal circumstances, financial or otherwise.