Aoifinn Devitt | Chief Investment Officer

Chris Kamykowski CFA®, CFP® | Head of Investment Strategy & Research

David Wickenhauser CFA®, CFP®,MBA | Investment Strategist

The first quarter was not the auspicious start to 2022 that many hoped to see. Markets remained on edge at the beginning of year despite ending 2021 on a brief high note, and the first quarter was dominated by market volatility, geopolitical risk, rising evidence of inflation and a more assertive stance by global central banks to address it.

Highlights

Volatility: Several market-jarring events in early 2022 led to sustained market volatility. Equity and interest rate volatility increased dramatically as markets contended with geopolitical events in Eastern Europe,

sharply higher inflation, economic growth concerns and rapidly shifting expectations for Fed action to tighten monetary policy. Despite these spikes, equity market volatility was still lower than during previous crises,

while interest rate volatility remained well above its historic averages and seemed likely to remain that way due to the rising rate environment that has been telegraphed.

Events in Russia and Ukraine: A key driver of consternation this quarter was Russia’s invasion of Ukraine, which upended the narratives of rising globalization and geopolitical order that had prevailed in recent years. Most of the developed world was quick to initiate sanctions across a slew of industries and individuals. Effects of this were felt particularly in commodity prices, with oil rising substantially given Russia represents 10% of oil export supply. A key component for steel – pig iron – rose substantially given Ukraine and Russia provide 50% of the total global exports.

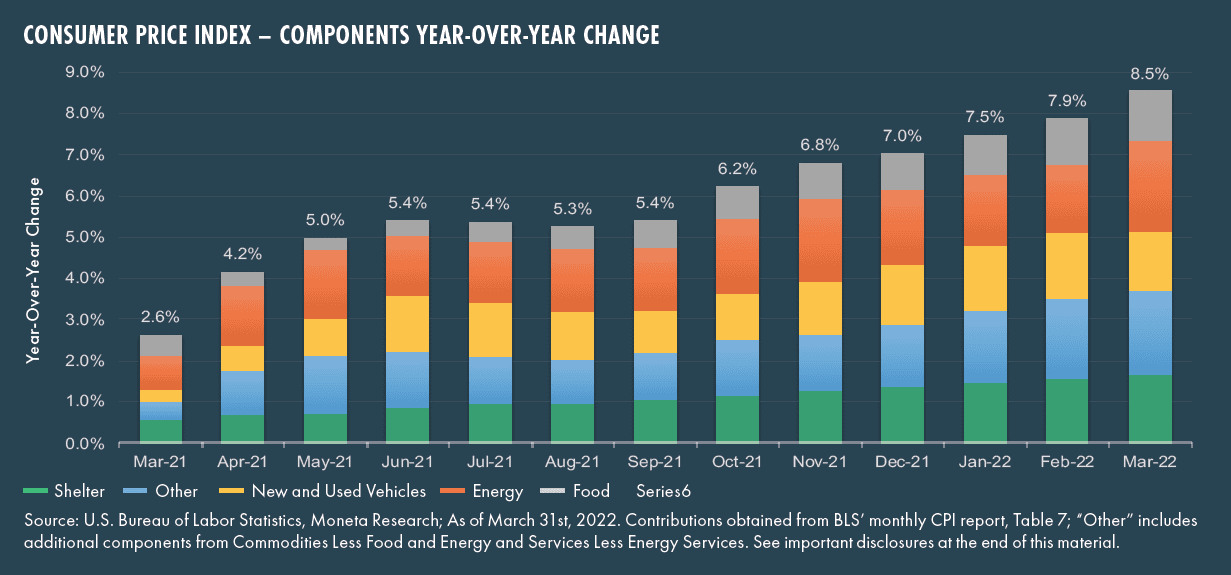

Inflation: While already headed higher due to a pandemic-induced imbalance in the economy between supply and demand, the events in Ukraine and subsequent sanctions added “fuel” to the rise in inflation

globally. US inflation hit a four-decade high in March with core inflation (ex food and energy) higher as well, highlighting the broadening of price pressures to housing and services. So far, long-term inflation expectations remain constrained, but the stickiness of the various components will be essential to watch to assess the longer-term trajectory.

Federal Reserve: With one part of their mandate fulfilled (maximum employment), the Fed had to shift to more aggressively addressing rising inflation while attempting to engineer a soft-landing for the economy as

monetary policy tightens. Additionally, quantitative tightening through reduced bond purchases will begin to reverse liquidity provided by quantitative easing (QE) and shrink the substantial increase in the Fed’s balance sheet.

Macro Overview

The U.S. unemployment rate fell to 3.6% in March, which is close to the pre-COVID (February 2020) levels of 3.5%. Payrolls for the quarter were up 1.7 million in the first three months of 2022 and now sit only 1.5 million short of pre-pandemic payroll levels. The participation rate continues to modestly improve with more people seeking jobs, which remain abundant. Consumer prices hit a new four-decade high of 8.5% in March with inflation broadening to housing and services, which are historically stickier as they change price relatively infrequently. Long-term inflation expectations remain stable for now as investors still expect inflation

to be attended to by the Fed and improvement in supply-chains to continue.

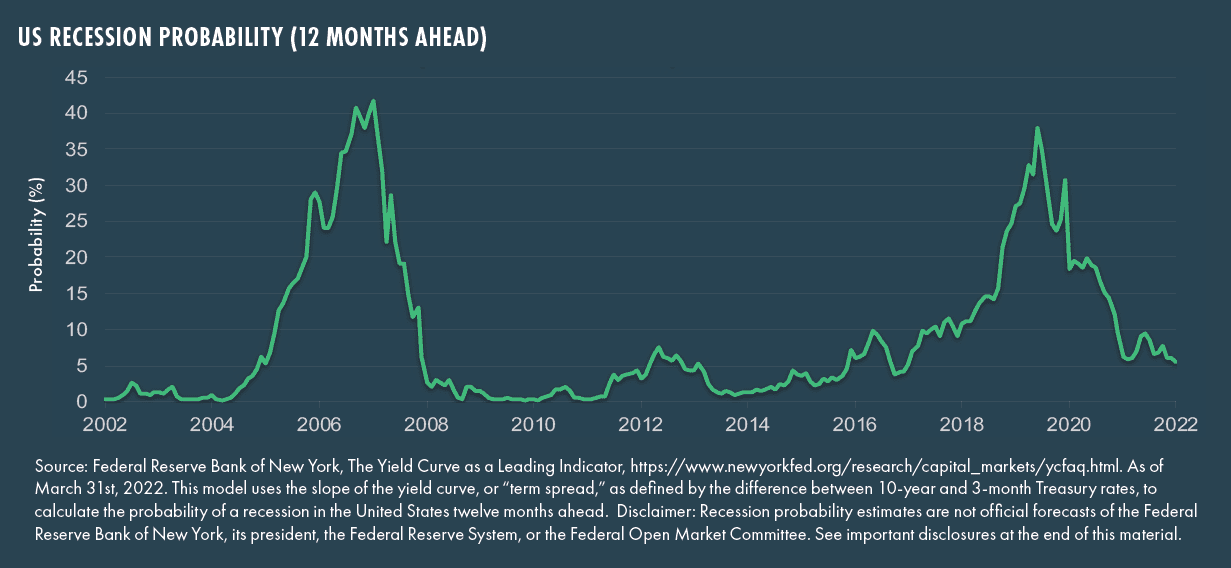

Expected rate hikes have moved from 4-5 to nearly 9 by the end of 2022 with the Fed likely to move at 50 bps increments over the next two meetings. Markets are currently assessing the potential risk of a pending recession, especially since the US yield curve inverted in late March (10 Year US Treasury vs 2 Year US Treasury). However, the Federal Reserve of New York’s recession indicator sees a slim chance of a recession in the next 12 months.

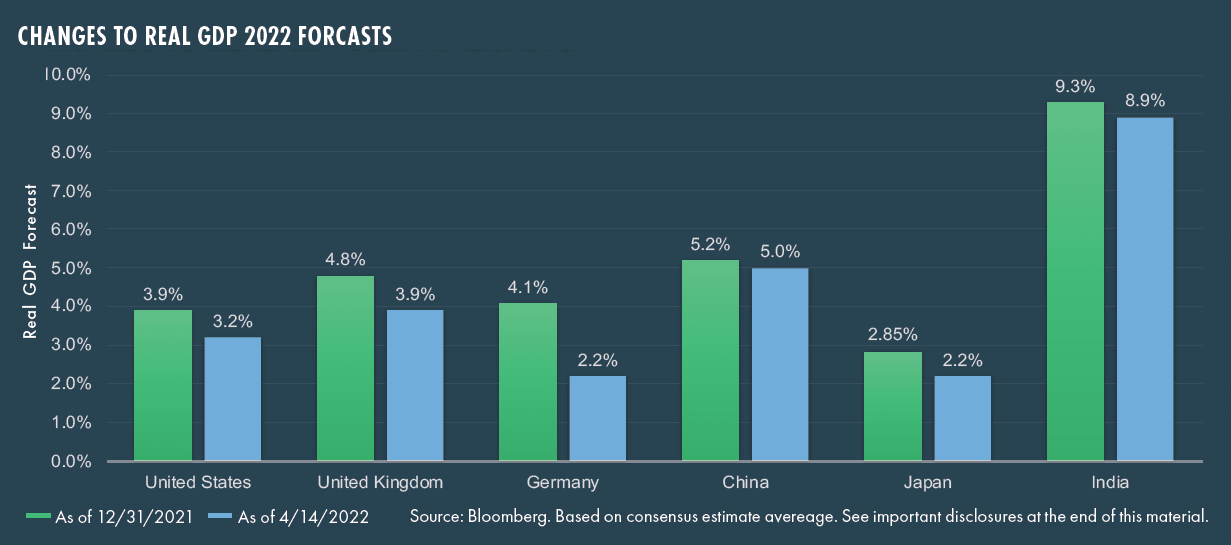

Monetary policy direction has diverged in the recent months across countries although it remains globally accommodative. Numerous central banks are addressing inflation head-on through tighter monetary policy while others require more flexibility in addressing inflation and slower growth due to the impact of an ongoing war (Europe) or COVID lockdowns (China). Still, growth uncertainty has entered 2022 forecasts across the board, although forecasted growth remains above trend. The US dollar remained strong throughout the quarter and recently hit its highest level in more than two years, amid expectations of interest rate rises by the Fed and a demand for safe-haven assets.

Asset Class Performance

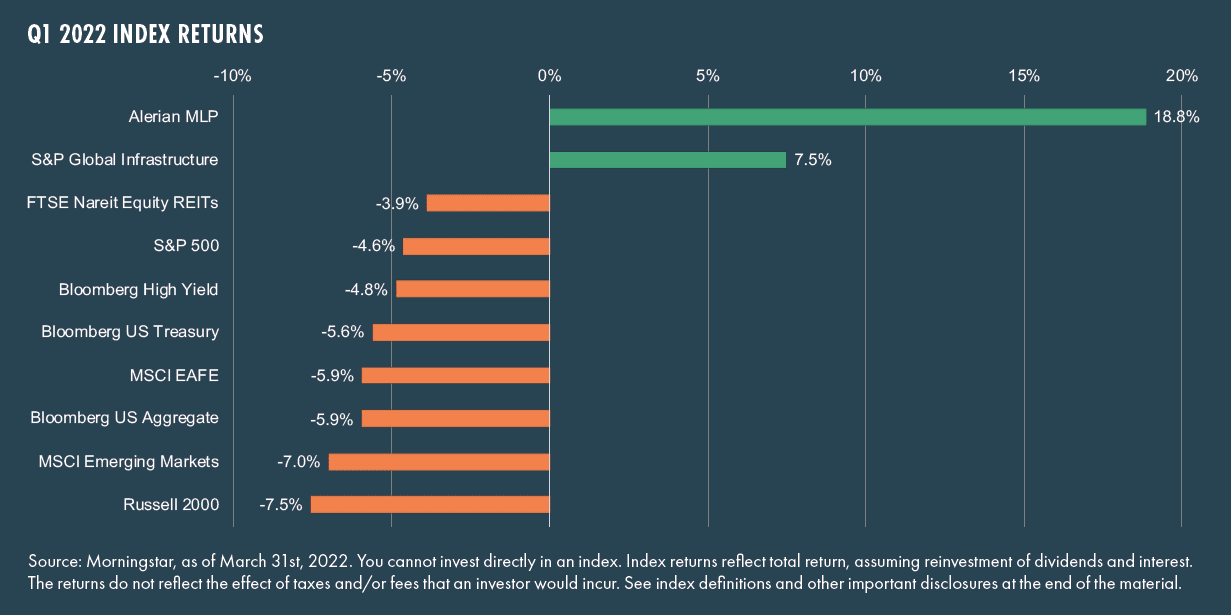

Across all maturities, Treasury yields have dramatically increased. While this means that investors can expect better yields on newly issued bonds, it also applies significant negative pressure on existing bond prices. This was clear in the first quarter as the Bloomberg Aggregate Bond index posted its third-worst quarter in history. Equity performance across the globe was broadly negative. Russian stocks experienced a -100% decline due to the heightened risk premiums and trade restrictions placed on the country’s equity securities, while commodity-linked emerging market countries, such as Brazil and Chile, bucked the trend with positive returns.

The S&P 500 posted a -4.6% decline for the quarter, primarily driven by significant drawdowns in the technology and consumer discretionary sectors. These sectors tend to be more growth focused over the long-term, meaning higher rates negatively impact the value of future earnings; this led to tech’s first drawdown since Q1 2020. The energy sector posted a 37%* return for the quarter as commodity prices surged, while utilities also had a modest gain of 4%*; the latter is currently the only sector that has not had a negative quarterly return since Q1 2020. (*Russell 1000 sector indices)

Large cap value stocks finished the quarter ahead of growth stocks with a +8.3% return advantage, marking one of the best relative quarterly returns by value versus growth. Both large and small cap growth sold off in the quarter, reaching bear market territory in mid-March before rebounding.

Following a banner year in REITs, rising rates brought returns down from recent highs for nearly all REIT sectors. Soaring commodity prices helped drive inflation higher but MLPs and infrastructure participated alongside the moves up, providing diversification to traditional equities and fixed income.

Final Thoughts

As the era of accommodative monetary policy comes to an end, there is considerable uncertainty around the trajectory and impact of the next cycle of rising interest rates. While low unemployment levels and still-strong levels of consumer spending may ward off a recession for now, the specter of slowing economic growth and pressure on earnings is adding to the stress on markets. Geopolitical concerns have, for the moment, moved from the headlines but have the potential to flare up again, which points to a period of sustained market volatility.

Tech stocks and their dramas have provided numerous headlines over the quarter, with Elon Musk’s audacious bid for Twitter and its ultimate acceptance as the latest chapter. Sensational coverage of these developments will most likely drive more volatility in growth stocks and fuel the rotation into value.

Yet, there are some green shoots amid the sea of stressors. Increased interest rates do not mean monetary policy is no longer accommodative, only less so than the emergency levels put in place due to the pandemic. While higher interest rates are certain to slow mortgage applications, housing, a key component of the economic growth, remains on a solid footing with demand still outpacing supply. Lastly, the economy appears geared to exit the pandemic-induced constraints as supply-chains are brought back in order and the service sector regains its share of the economic pie from the goods-producing sector.

Definitions & Disclosure

Alerian MLP Index: The Alerian MLP Index is a capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities.

Bloomberg US Aggregate: The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollardenominated, fixed-rate taxable bond market.

Bloomberg High Yield: The Bloomberg Barclays US Corporate High Yield Bond Index measures the USD-denominated, high yield, fixed-rate corporate bond market.

Bloomberg US Treasury: The Bloomberg Barclays US Treasury Index measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury.

FTSE Nareit Equity REITs: The FTSE Nareit All Equity REITs Index is a free-float adjusted, market capitalization-weighted index of U.S. equity REITs. Constituents of the index include all tax-qualified REITs with more than 50 percent of total assets in qualifying real estate assets other than mortgages secured by real property.

MSCI EAFE: The MSCI EAFE Index is an equity index which captures large and mid-cap representation across 21 Developed Markets countries around the world, excluding the US and Canada.

MSCI Emerging Markets: The MSCI Emerging Markets Index captures large and mid-cap representation across 27 Emerging Markets (EM) countries.

Russell 2000: The Russell 2000 Index is a small-cap stock market index of the smallest 2,000 stocks in the Russell 3000 Index.

S&P 500: The S&P 500 Index is a market-capitalization-weighted index of the 500 largest domestic U.S. stocks.

S&P Global Infrastructure: The S&P Global Infrastructure Index provides liquid and tradable exposure to 75 companies from around the world that represent the listed infrastructure universe. The index has balanced weights across three distinct infrastructure clusters: Utilities, Transportation, and Energy.

Real GDP: Real gross domestic product is an inflation-adjusted measure that reflects the value of all goods and services produced by an economy in a given year (expressed in base-year prices) and is often referred to as constant-price GDP, inflation-corrected GDP, or constant dollar GDP. Forecasts for 2022 real GDP growth are based on 76 contributions from leading banks and financial institutions.

© 2022 Moneta Group Investment Advisors, LLC. All rights reserved. These materials were prepared for informational purposes only based on materials deemed reliable, but the accuracy of which has not been verified. Trademarks and copyrights of materials referenced herein are the property of their respective owners. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. You cannot invest directly in an index. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.