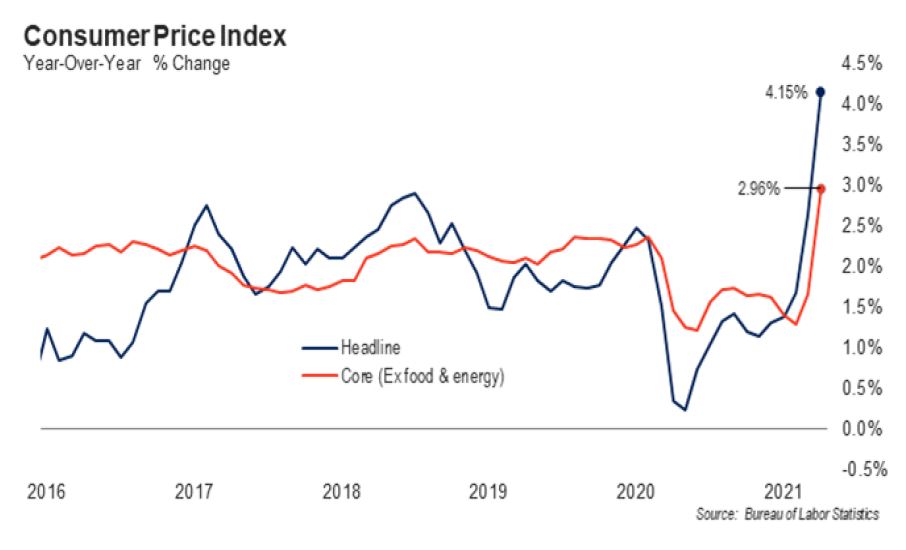

Last week, the Bureau of Labor Statistics reported that U.S. consumer prices exploded in April by the most since 2009 – far exceeding consensus and fueling the debate about how long inflationary pressures will last. Headline CPI rose 0.8% in April from March for a 4.2% year-over-year increase, both well above consensus of 0.2% and 3.6%, respectively. Core CPI, which excludes food and energy, also rose significantly with a monthly gain of 0.9% and a 3.0% year-over-year increase, again both well above consensus of 0.3% and 2.3%, respectively.

March of this year was the first month in this cycle where the “base effect” came into play, biasing the year-over-year reading upward. From February to March of 2020, prices suffered a steep decline as lockdowns began and economic activity slowed significantly across the country. The “base,” or very low CPI figure from March 2020, distorted the March 2021 YOY figure. As anticipated, the base effect impacted the April 2021 YOY reading as well. This will continue for a few more months but the effect will naturally taper off.

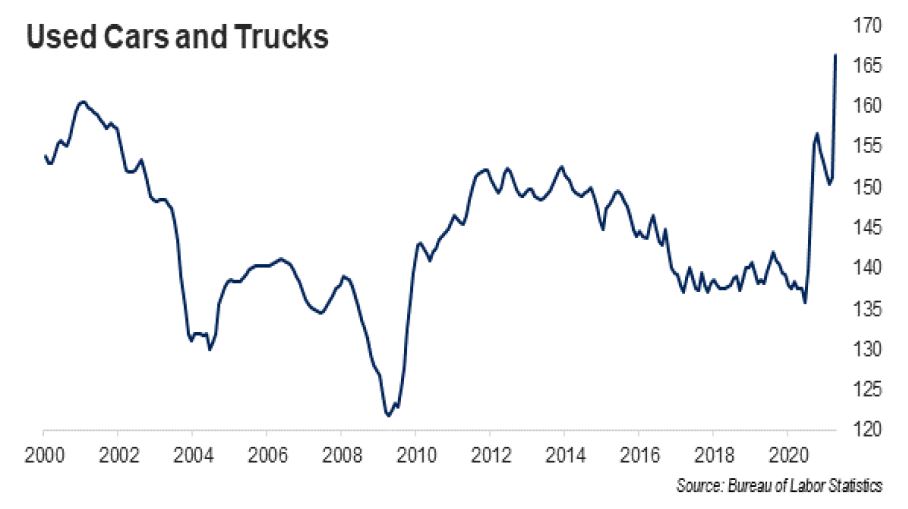

While the base effect is certainly affecting YOY figures, it does not explain the monthly increases in April. Rather, the monthly increases can be attributed to a combination of supply chain disruptions, reflation, and roaring consumer demand as our economic recovery continues to gain traction. The largest contributor to the increase in core CPI came from a 10% surge in prices on used cars and trucks in April compared to March. This marks the largest monthly increase on record. Used autos are currently in very short supply and cost 20.9% more now than in February 2020.

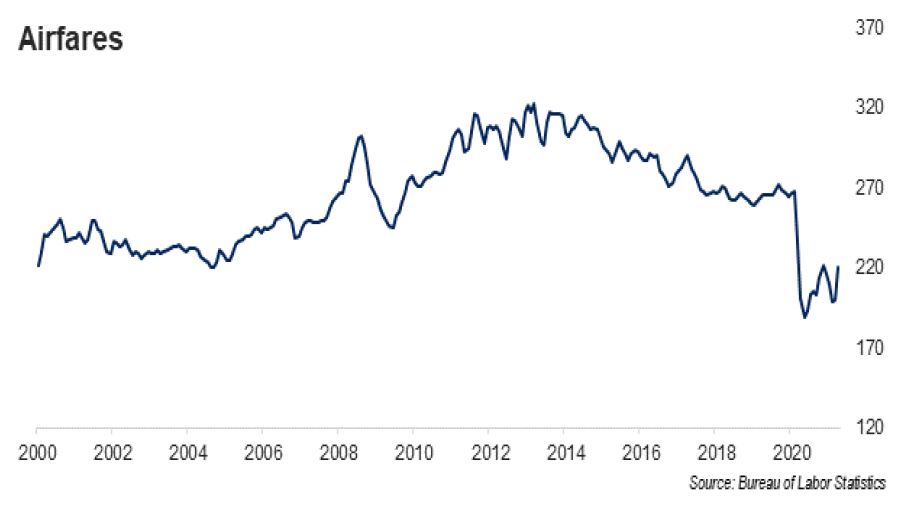

The travel and hospitality categories also had significant price increases, with airfares up 1 0.2%, car and truck rentals up 16.2%, and hotels and motels up 8.8%. While some of these sectors had larger increases than the aforementioned used cars and trucks, they are a smaller contributor to CPI due to a smaller weighting in the calculation. These increases aren’t really inflation, but rather reflation with prices returning to levels consistent with companies staying in business. As you will see in the chart on the following page, airfare prices are still well below levels seen in 2019.

The Fed has remained steadfast in its belief that these price increases will be temporary. Shortly after April’s CPI report was released, Federal Reserve Vice Chairman Richard Clarida admitted he was surprised by the jump in consumer prices but reiterated the stance that the rise would prove to be largely transitory. He referred to April’s numbers as “one data point” and also said, “I expect inflation to return to – or perhaps run somewhat above – our 2% longer-run goal in 2022 and 2023.” Clarida also repeatedly said the Fed was prepared to act if inflation or inflation expectations rose to undesirable levels, saying, “If we saw evidence that there was a risk of a persistent upward drift in inflation expectations, we would not hesitate to use our tools to offset that.”

It’s important to note that while CPI receives most of the attention and time in the press, it’s not the Federal Reserve’ s preferred measure of inflation; that is Core Personal Consumption Expenditures (PCE). CPI and PCE are different for a variety of reasons, including the fact CPI is based on household purchase data while PCE uses data on what businesses are selling. Historically, Core PCE levels average less than Core CPI’ s, but both have generally trailed the Fed’s 2% target for the better part of the last decade. Given this specific target has shifted to an average of 2%, the Fed will now allow inflation to rise above 2% for a time in order hit the target.

April’s numbers were high, but somewhat anticipated given the unprecedented fiscal stimulus, base effects, and supply chain disruptions. One thing is certain: inflation will continue to be a hot topic in the coming months; this combined with historically low interest rates and uneven global economic recovery will lead to increased scrutiny of one’s fixed income allocation. The Fed has not wavered in its commitment to keeping yields at or near zero until 2023 as the country continues to recover. With that in mind, we recommend investors resist the urge to stay ultra-short and instead consider adding or increasing exposure to high-yield funds while maintaining a bond ladder. When bonds mature, we recommend reinvesting at the end of the ladder to take advantage of higher yields further out on the curve.

These materials have been prepared far informational purposes only based an materials deemed reliable, but the accuracy of which has not been verified. Post performance is not indicative of future returns. These materials do not constitute an offer or recommendation to buy or sell securities, and do not take into consideration your circumstances, financial or otherwise. You should consult with an appropriately credentialed investment professional before making any investment decision.