By Bill Hornbarger, Chief Investment Officer at Moneta

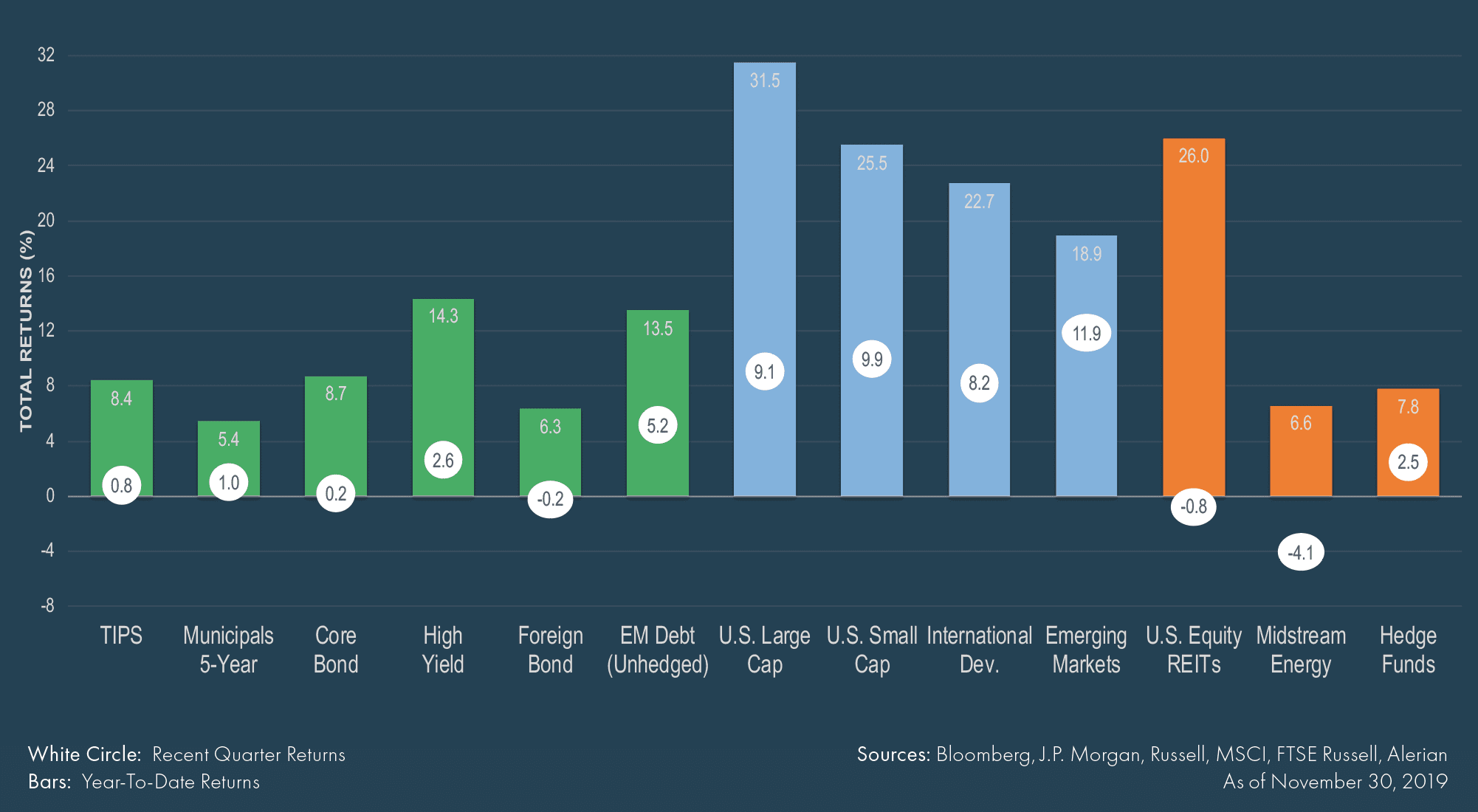

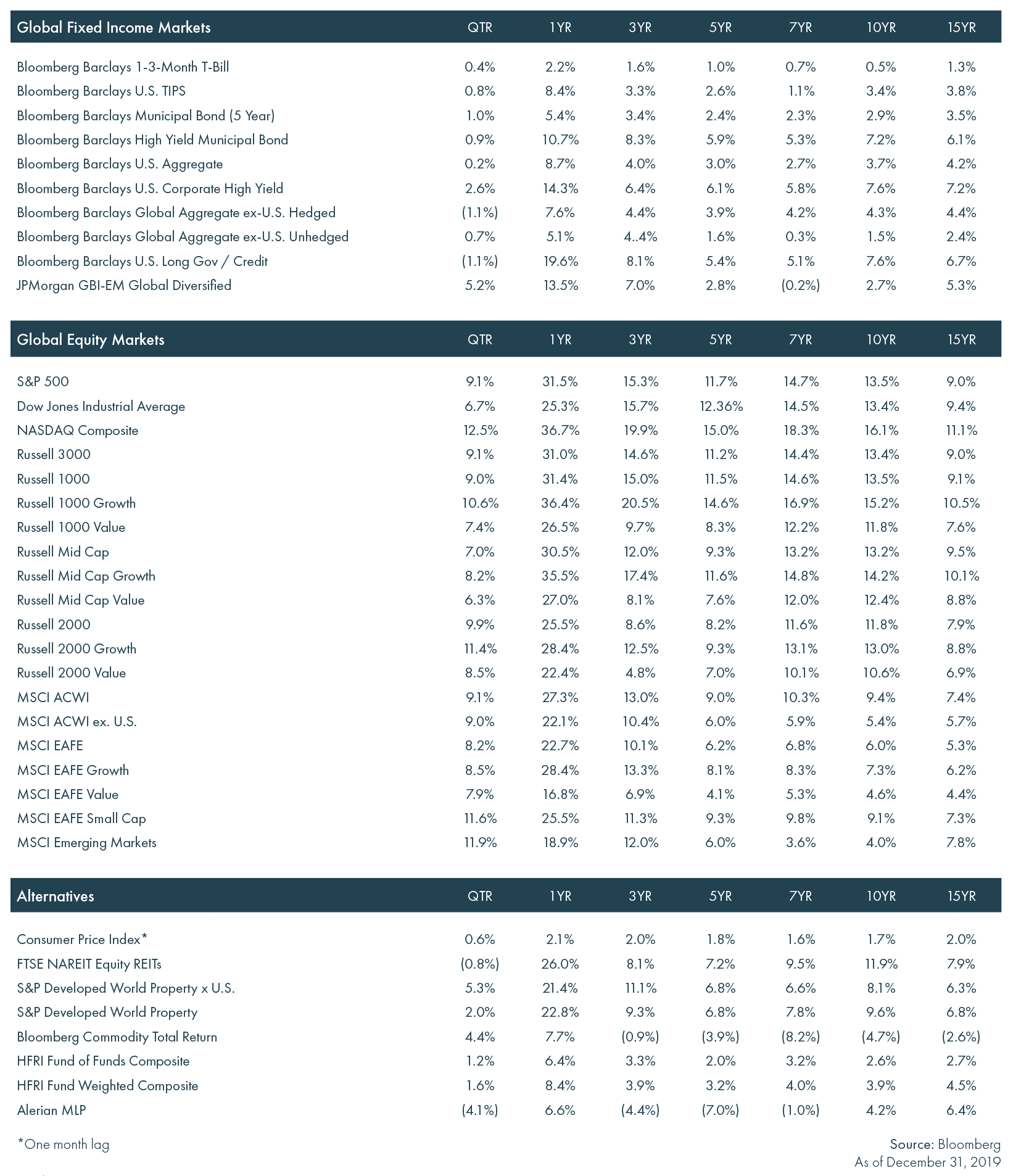

Last year was a banner year for the financial markets. Every major asset class we track produced positive returns, led by U.S large cap growth stocks with the S&P 500 posting a 31.5% return. Despite relatively low nominal yields at the beginning of 2019, the widely followed Bloomberg Barclays Aggregate Bond Index gained 8.7% and international equities (both developed and emerging) posted strong gains. Several asset classes hit new all-time highs and many markets would be considered “fully valued” at year-end.

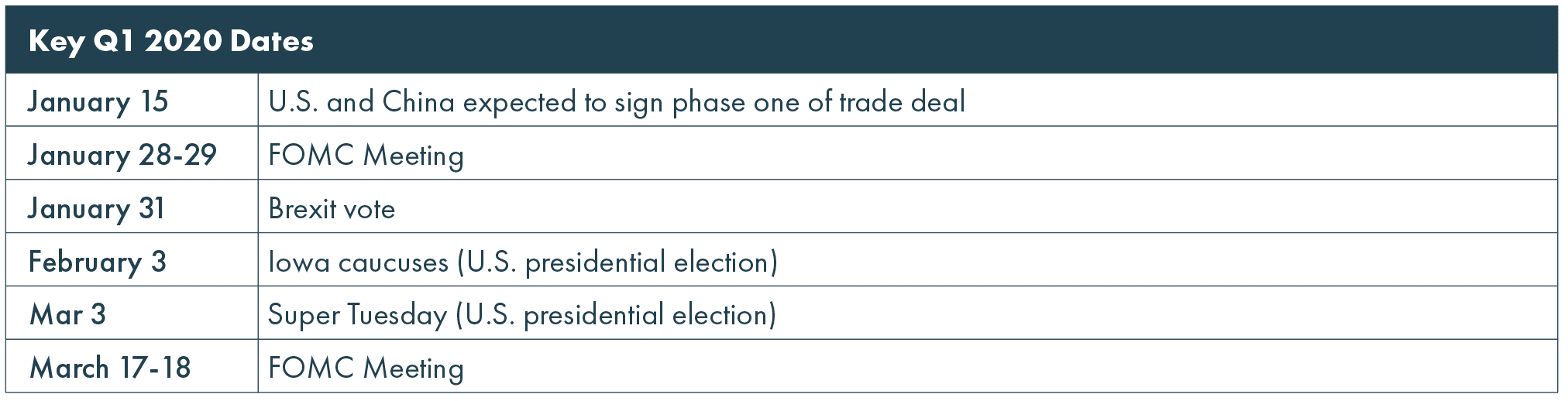

Many investors are wondering what 2020 will hold in the wake of these strong gains. Accommodative monetary policy, a “phase one” U.S.-China trade deal and transparency on Brexit provide some clarity and reasons for optimisms. These are counterbalanced by the fact that the global economy ended 2019 on a weak note and 2020 will feature what promises to be a contentious election cycle, potentially sapping confidence.

Coming out of last year’s strong gains into what we see as a more uncertain environment in 2020, we would make the following observations/recommendations as investors review their portfolios:

Managing risk will be more important than targeting return

The strong rebound in equity valuations following the fourth quarter sell-off in 2018 may have run its course. We believe the current climate creates challenges for incremental equity valuation expansion. Therefore, we caution against reaching for return and favor reassessing total portfolio risk tolerances.

Have realistic return expectations, particularly for bonds

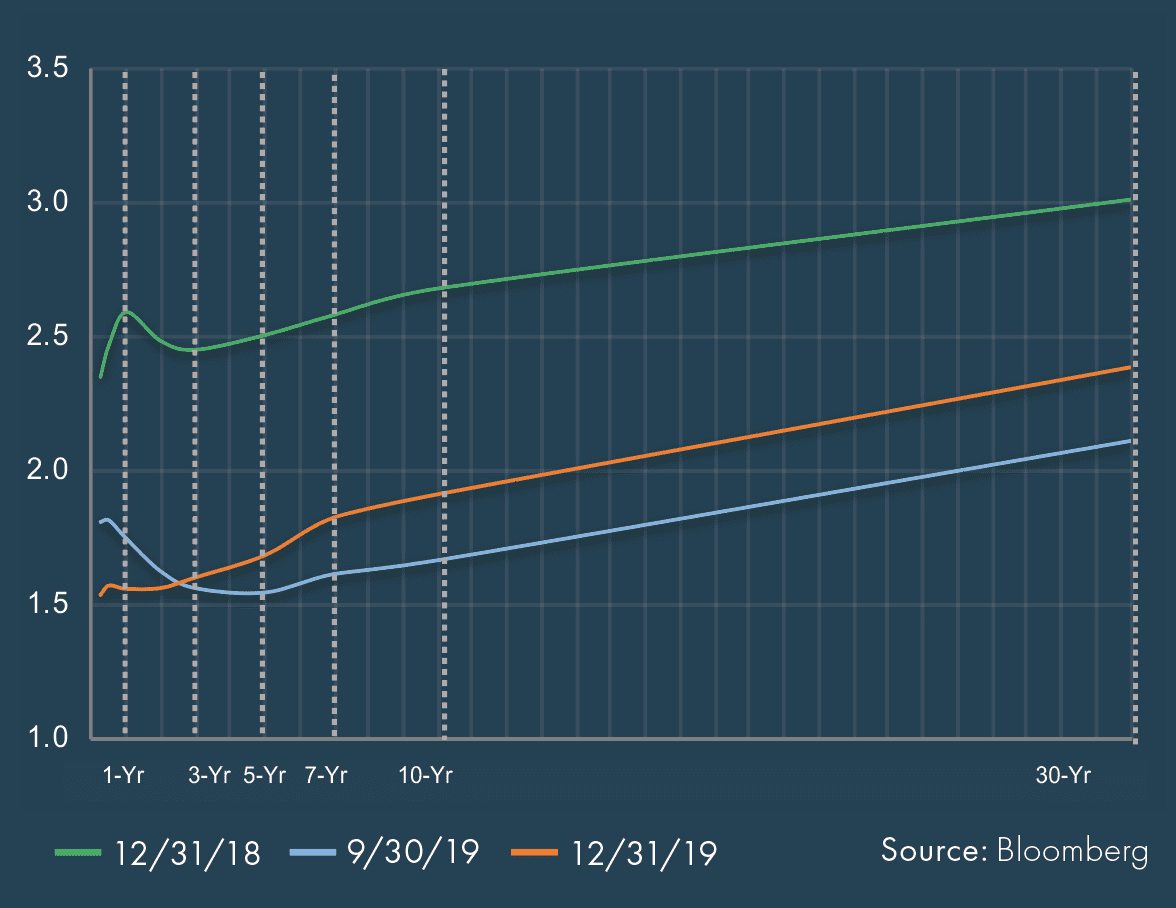

The decade after the end of the Global Financial Crisis experienced very strong returns for equities. While we hope they continue, we realize hope is not a strategy. With most equity sectors trading at above-average valuations, our belief in mean reversion leads us to expect a period of below-average returns after the recent period of above-average returns. Whether those start in 2020 or later and what form they take is unknown. We think it is also important to recognize that bond yields declined last year and are at levels that make further gains beyond the coupon rates more difficult.

Do not ignore international allocations

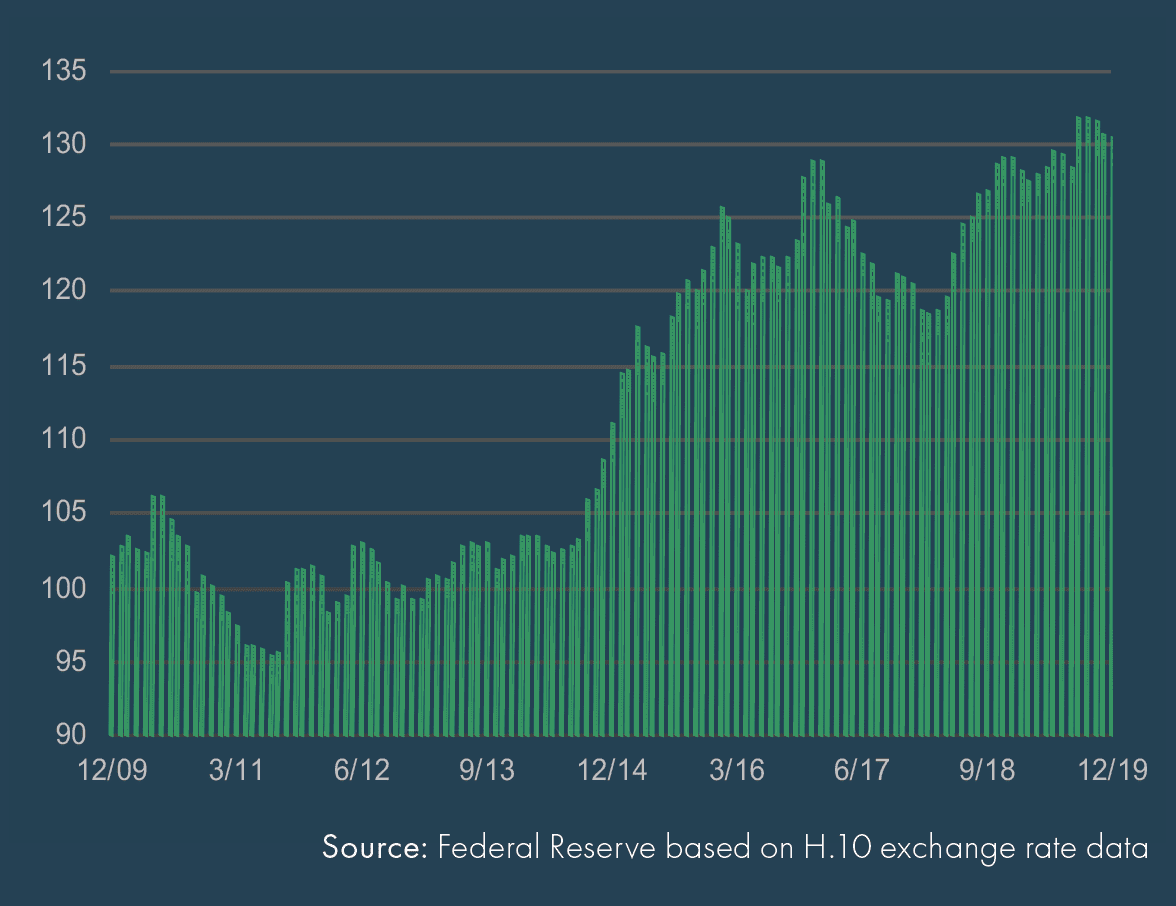

U.S. stocks once again led the rebound in global equities despite relatively more attractive valuations on international equities at the beginning of 2019. In fact, despite carrying a relatively elevated valuation each year, the S&P 500 Index outperformed the MSCI EAFE Index in seven of the last 10 calendar years! Since 1978, however, the S&P 500 Index outperformed the MSCI EAFE Index in just 22 of the last 42 (52%) calendar years. Furthermore, our research shows relative performance between domestic and international equities is cyclical and influenced by U.S. dollar strength (or weakness) relative to major currencies. While valuations are observable and measurable, currency fluctuations are difficult to predict. Therefore, given international equities have relatively more favorable valuations and the prospect that U.S. dollar strength may abate, we continue to recommend global equity diversification.

Do not reach for yield

There is a famous investment quote that states, “More money has been lost reaching for yield than at the point of a gun.” Another late-cycle trend, credit stress, emerged in the second half of 2019 despite three Fed rate cuts and a “not-QE” reboot. In a low-rate, late-cycle environment, we are conscious of the heightened risk in the credit markets. We still believe a thoughtful, strategic allocation to high yield is warranted, but have a heightened sense of caution to overweighting lower credit quality bonds, bank loans and direct lending. More tempered allocations to credit and thoughtful utilization of active bond managers – especially within high yield bonds – to navigate the level of quality in today’s market are prudent activities.

Review spending policies

Saving and spending are two things completely in each investor’s control. A periodic review, particularly after a strong period of returns, is a good practice.

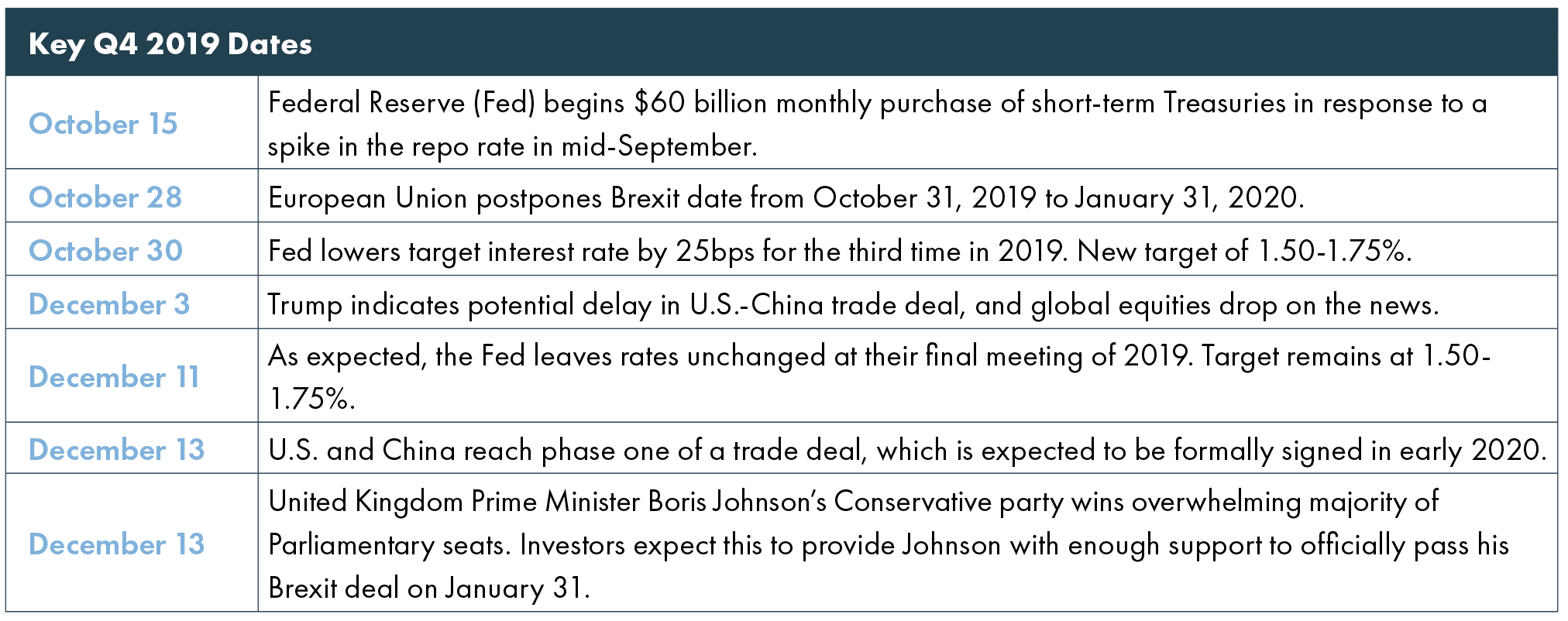

Q4 2019 Market Events

Asset Class Performance

Fixed Income

+ Tightening spreads amid a generally healthy economic backdrop

– Rising global interest rates

+ Low inflation and a weaker U.S. dollar supported local EM debt

Equities

+ Moderating geopolitical risks

+ Strong 3Q 2019 U.S. earnings season

+ Weaker U.S. dollar benefitted emerging markets

Alternatives

– Oil production slowdown and year-end selling pressures weighed on midstream energy

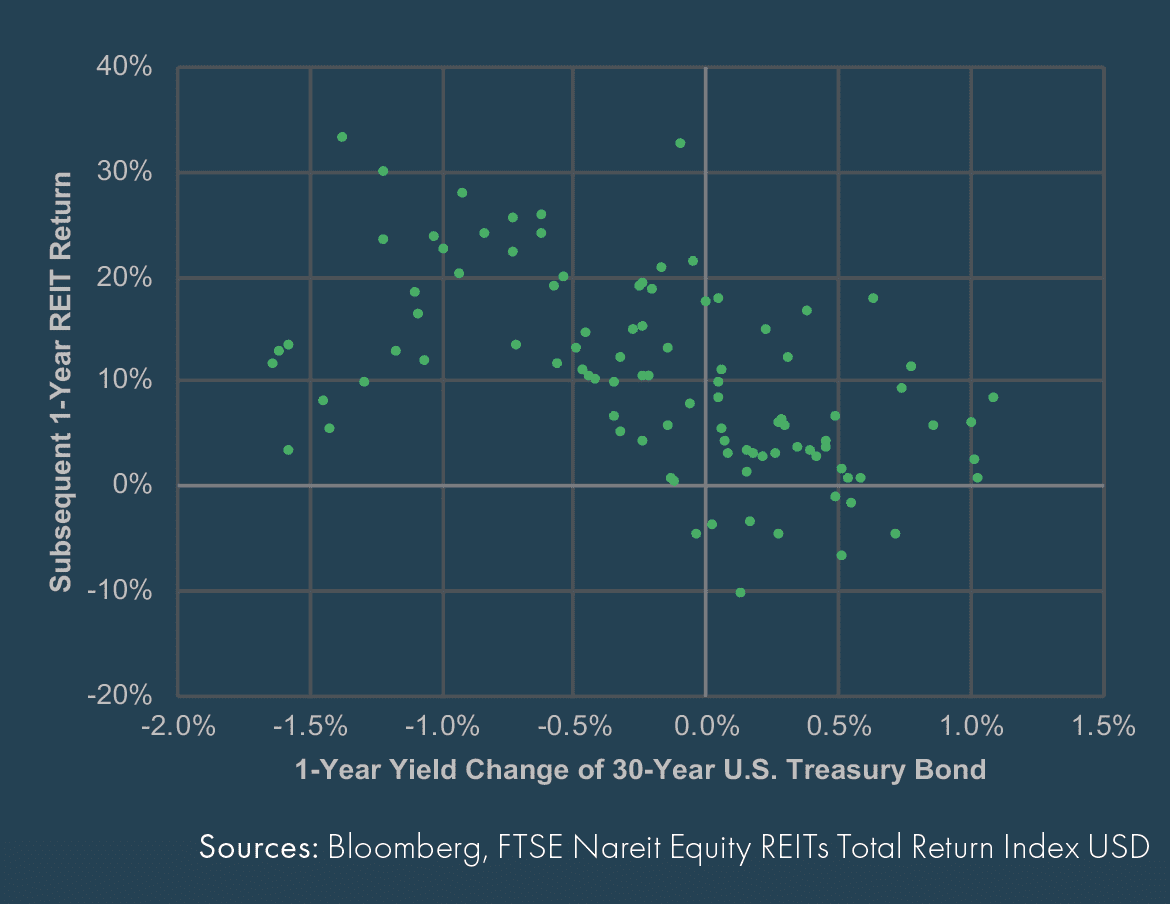

– Higher interest rates modestly weighed on real estate markets

Market Themes

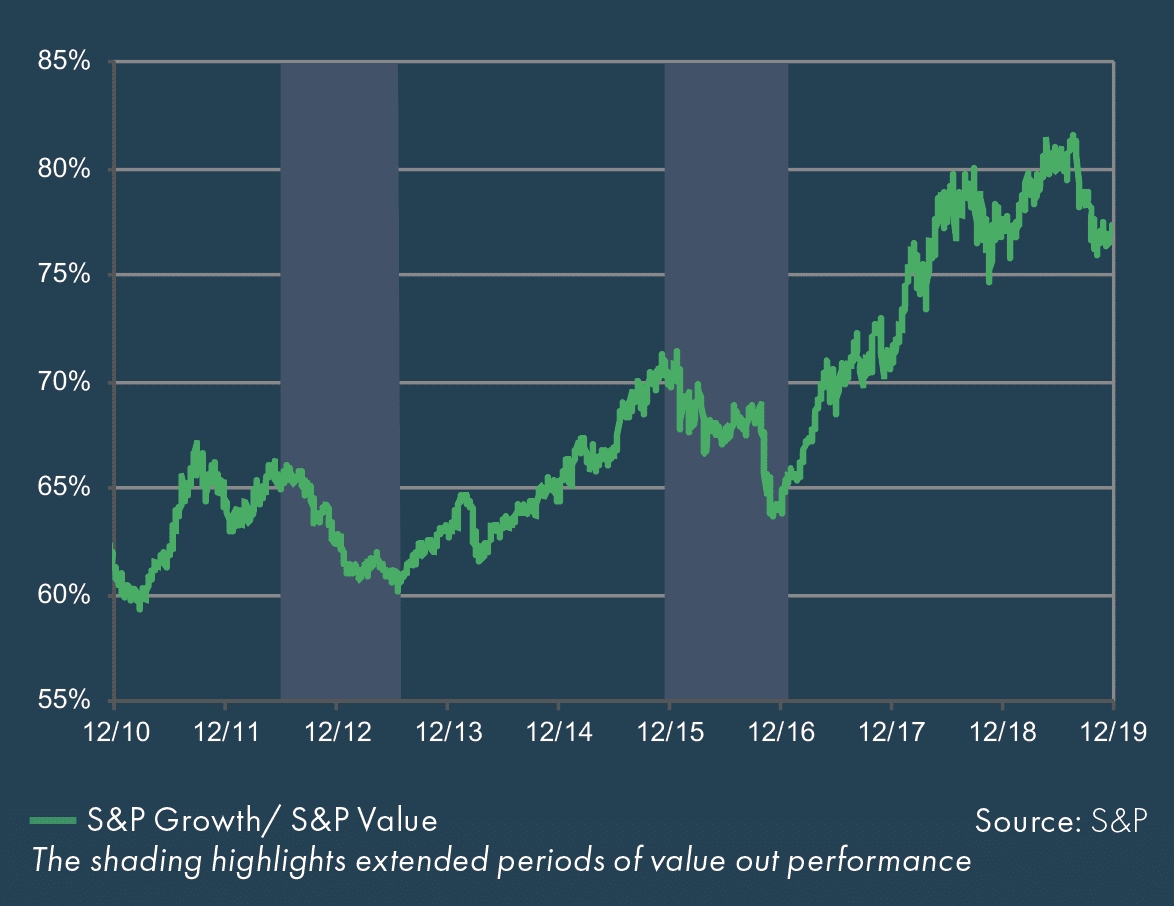

Equity – Growth vs. Value

Growth stocks have meaningfully outperformed value stocks over the last decade with only small pockets of value out performance.

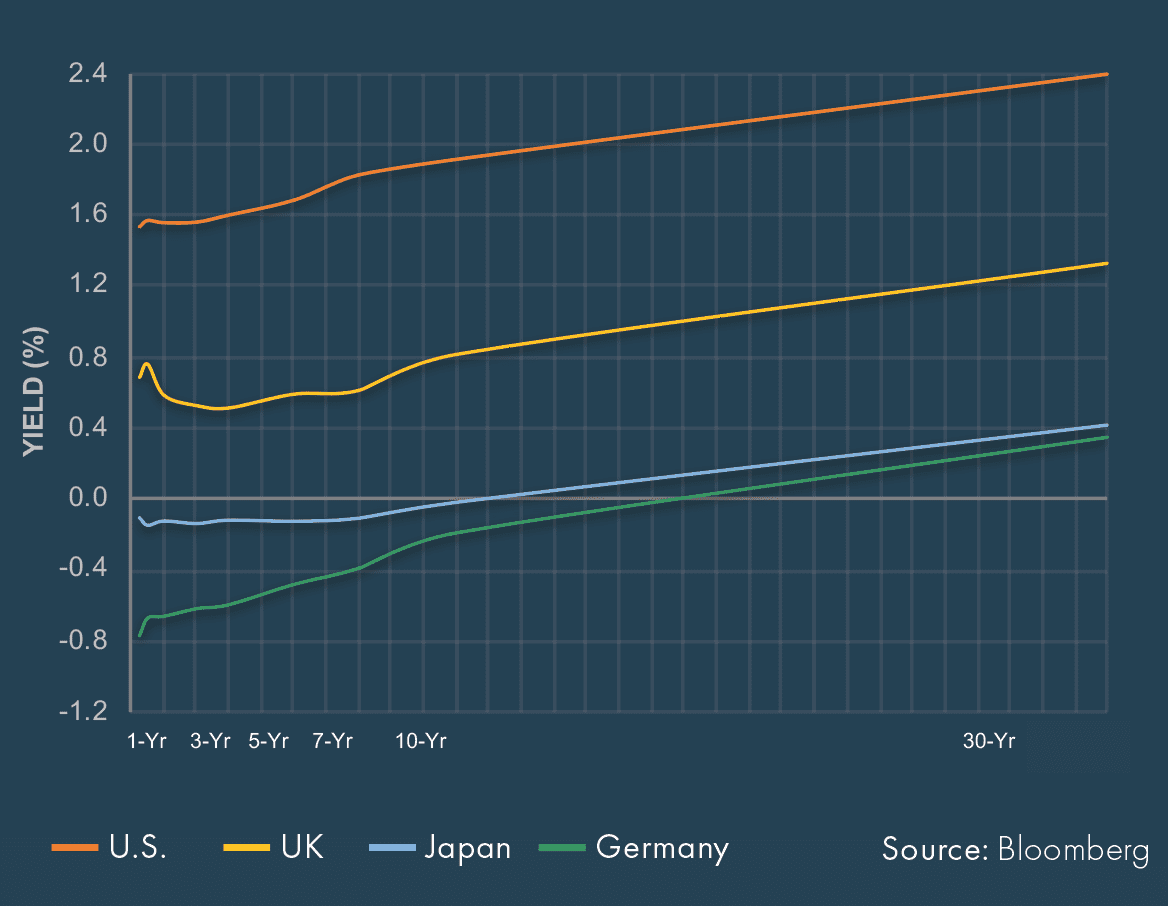

Government Bond Curves

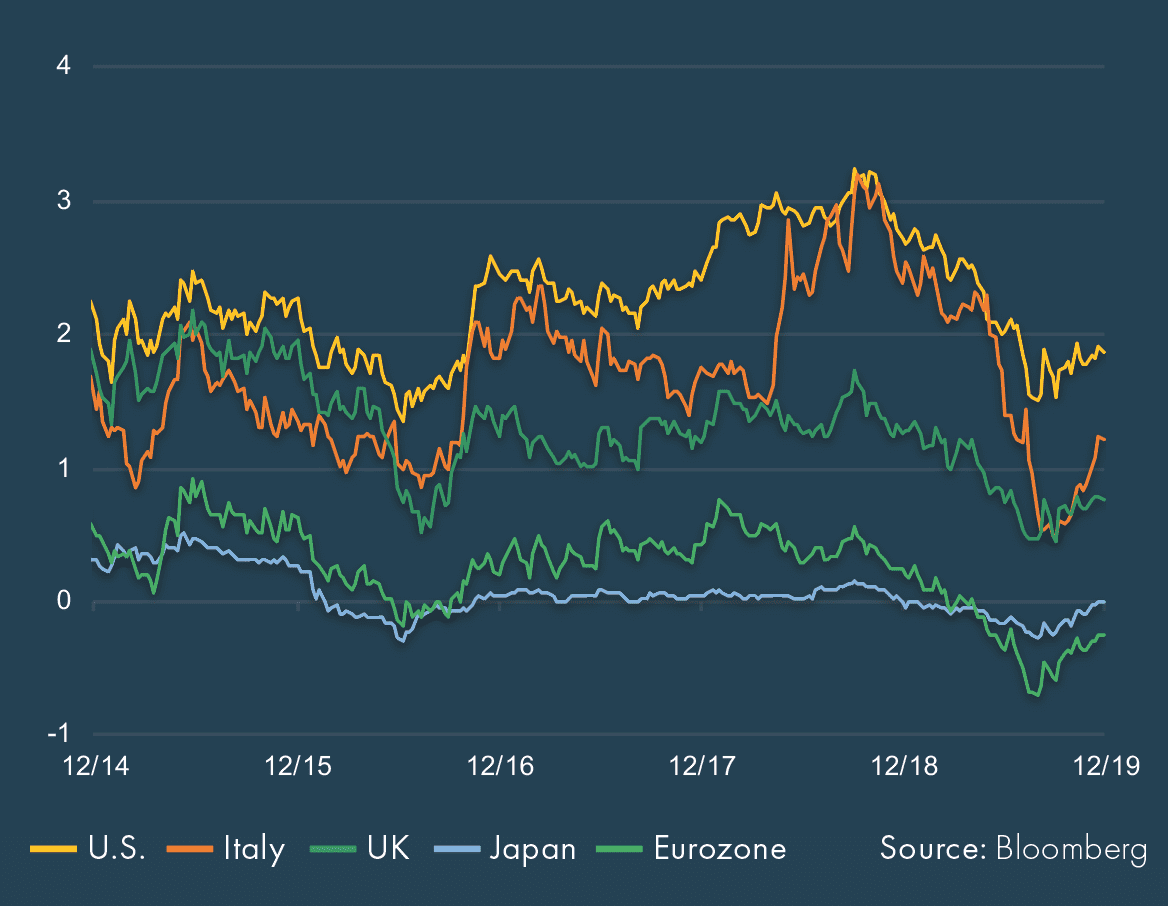

Roughly $11 trillion of government debt is trading with negative yields, and that includes some long-maturity bonds.

Trade Weighted U.S. Dollar

The dollar weakened modestly in the fourth quarter, which was a reversal of what investors saw for most of 2019.

REITs Relationship with Interest Rates (2011-2019)

Historically, low or falling interest rates have been associated with future periods of positive REIT performance.

Fixed Income Market Update

U.S. Treasury Curve

The Treasury curve reverted back to a normal positive slope with short-term rates falling and longer-term rates rising.

Global 10-Year Government Yields (%)

Government yields ticked higher across most regions but remain historically low and still negative in Japan and the Eurozone.

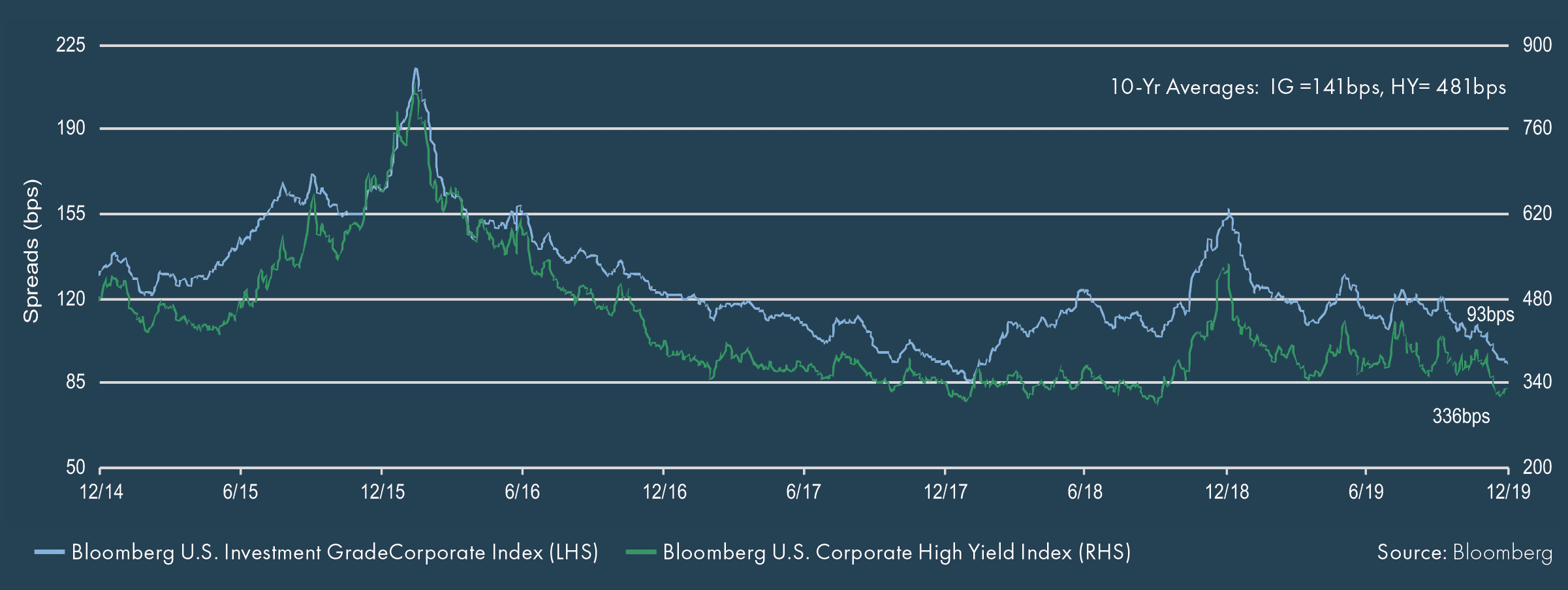

Credit Market Spreads – Trailing 5 Years

Spreads ground tighter in the fourth quarter amid a relatively subdued geopolitical environment. Investment Grade and High Yield spreads remain well below their 10-year averages.

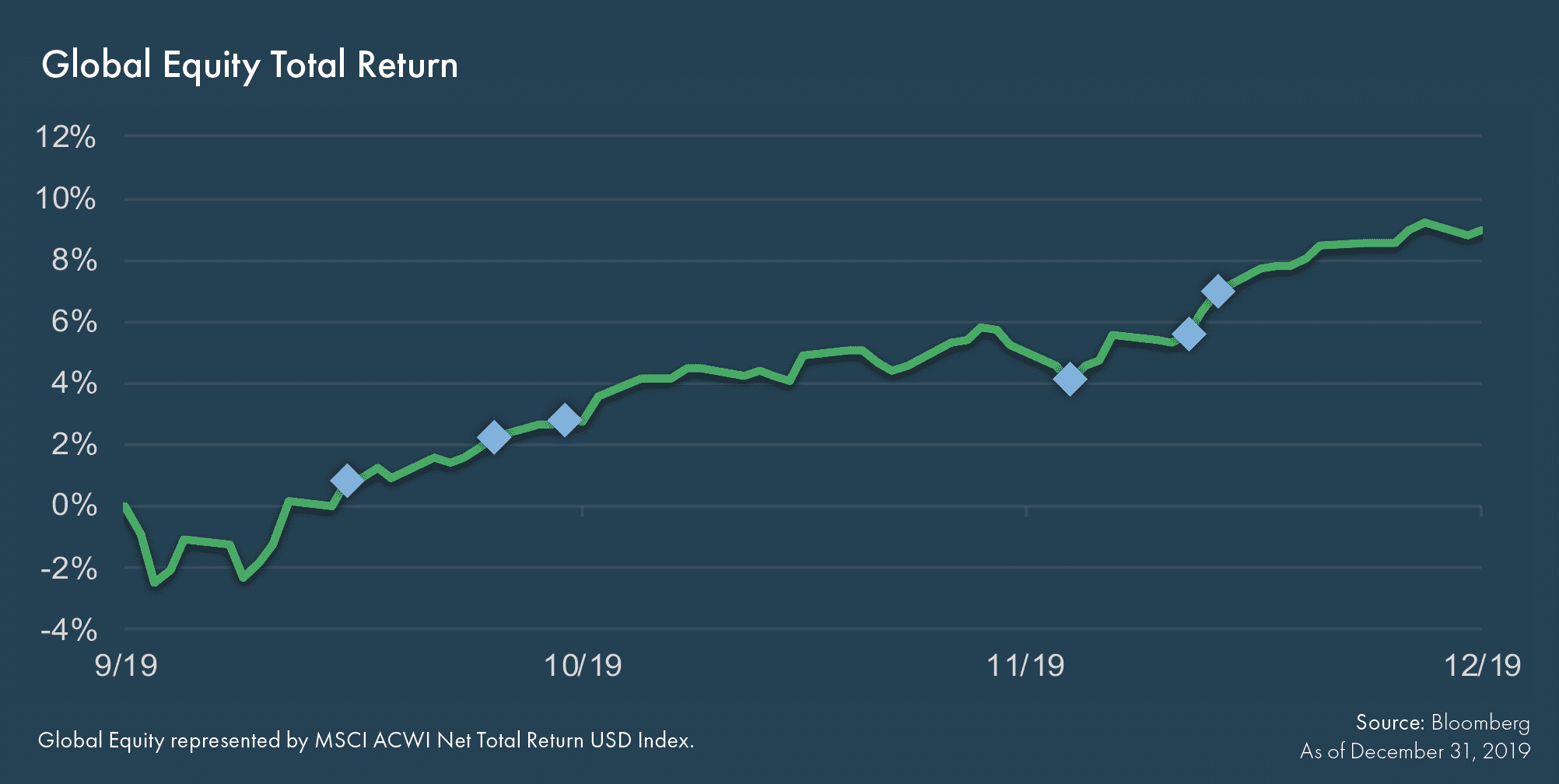

Equity Market Update

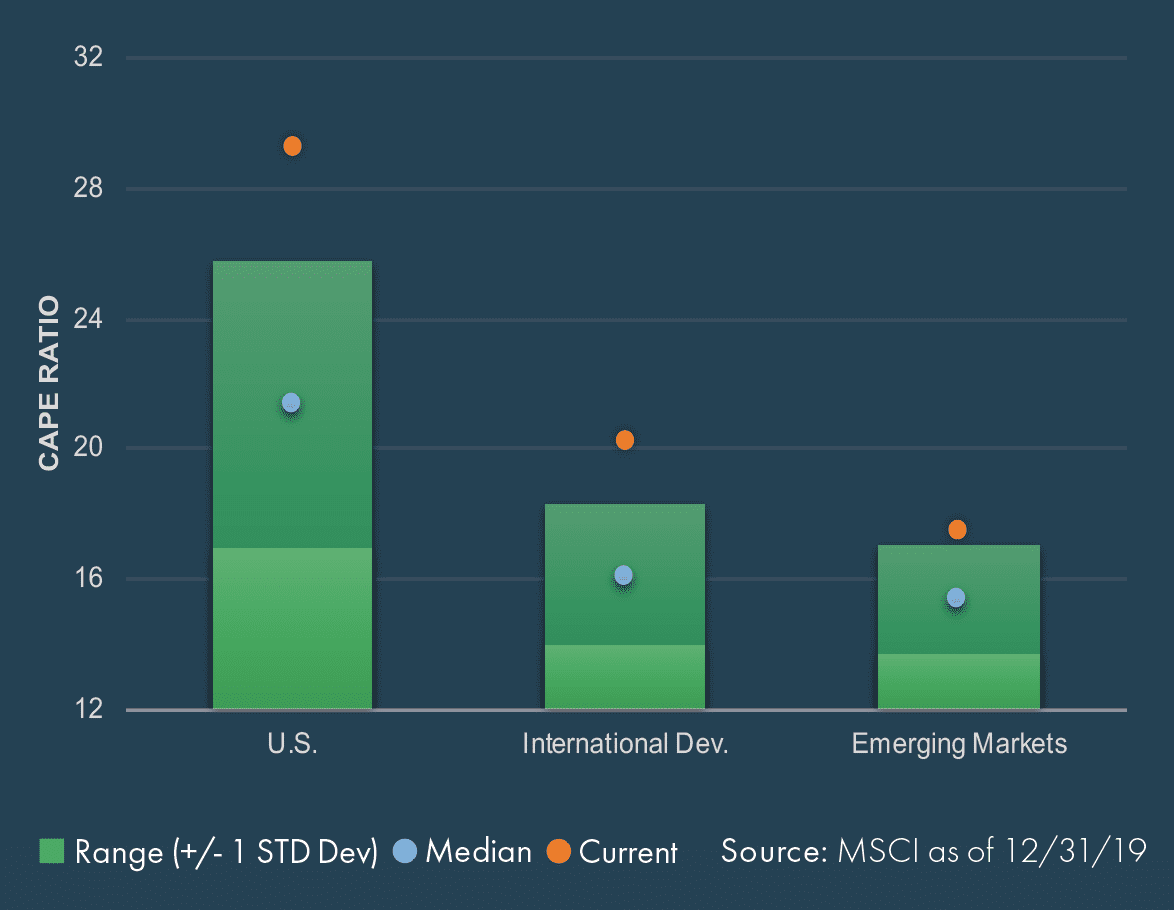

Equity Valuations (Trailing 10 Years)

Valuations across developed and emerging markets are trading above median levels, most noticeably in the U.S.

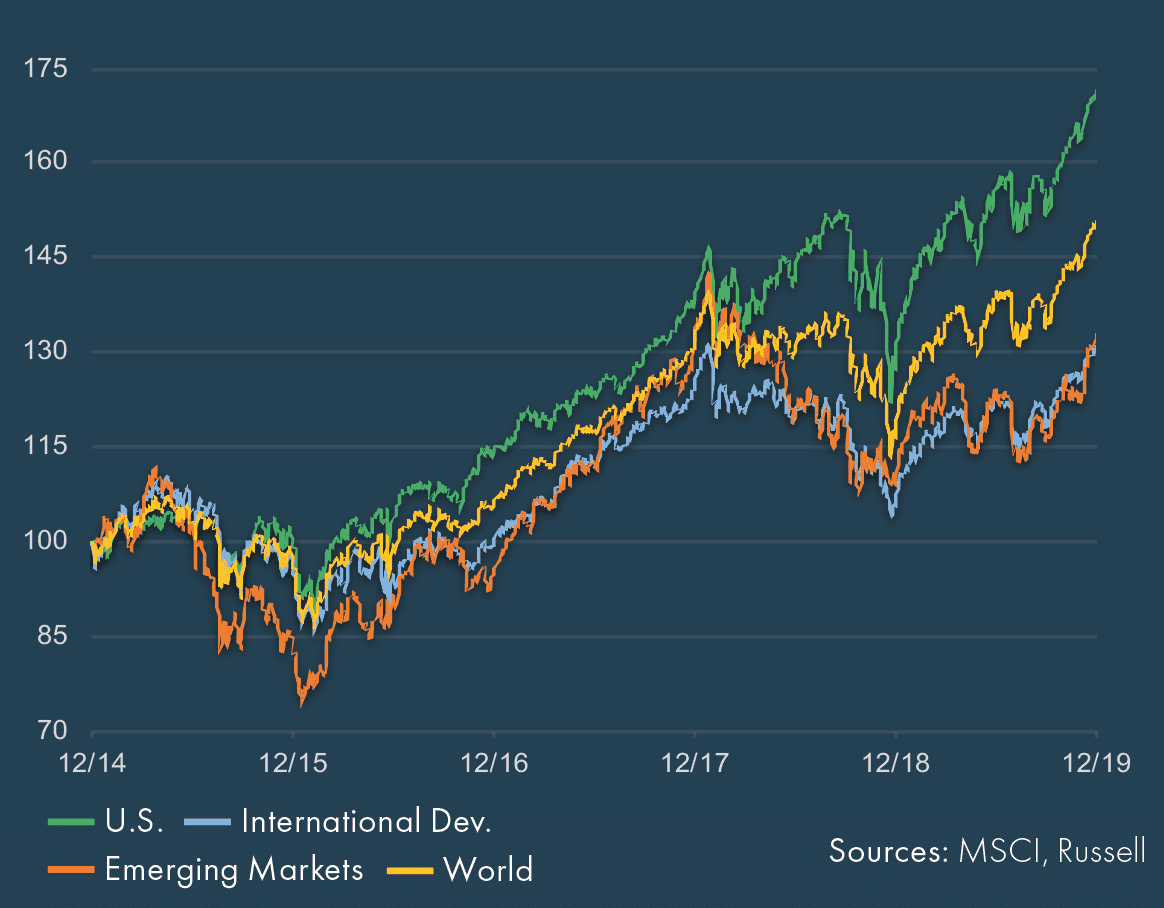

Equities – Growth of $100 over Trailing 5 Years

U.S. equities have outperformed the broader market since 2015, but all regions experienced solid positive returns in 4Q 2019.

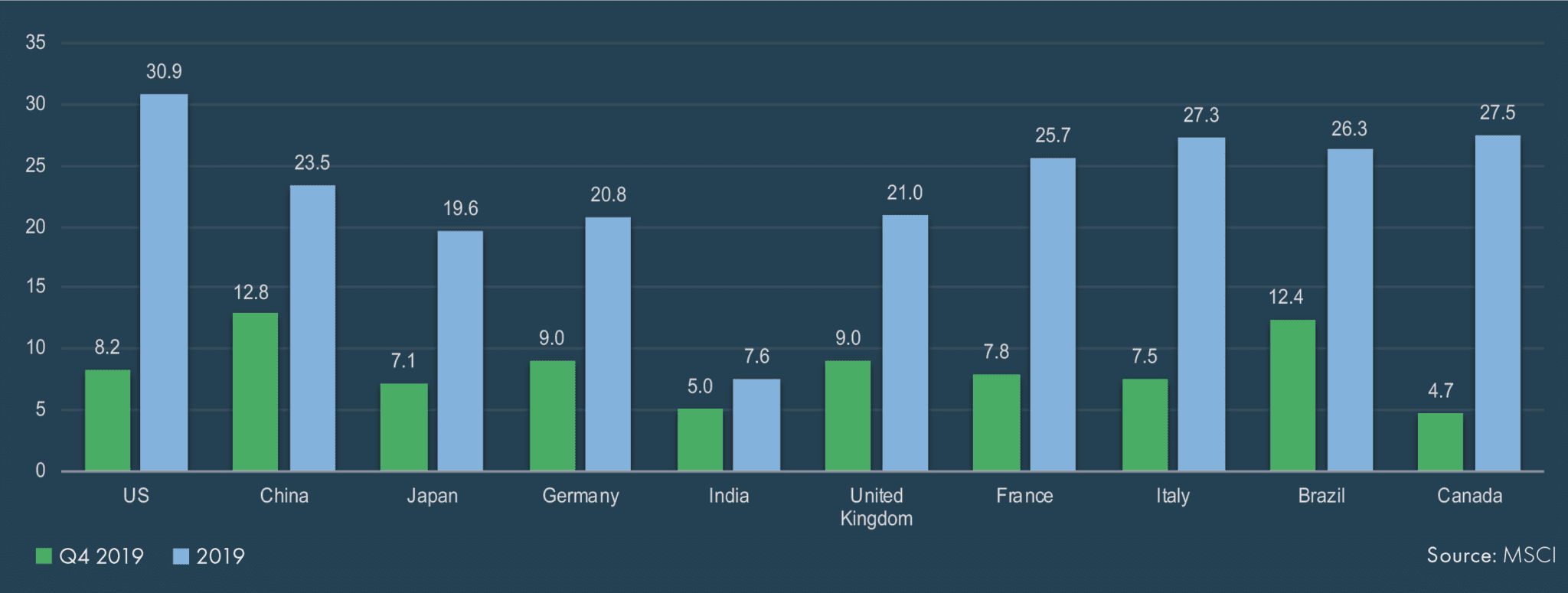

Country Total Returns (%) – Top 10 Largest Economies

Most major countries generated strong absolute returns with Brazil and China leading the way. Structural economic reforms in Brazil and U.S. trade negotiation progress in China benefitted the equity markets in the fourth quarter.

Alternatives Market Update

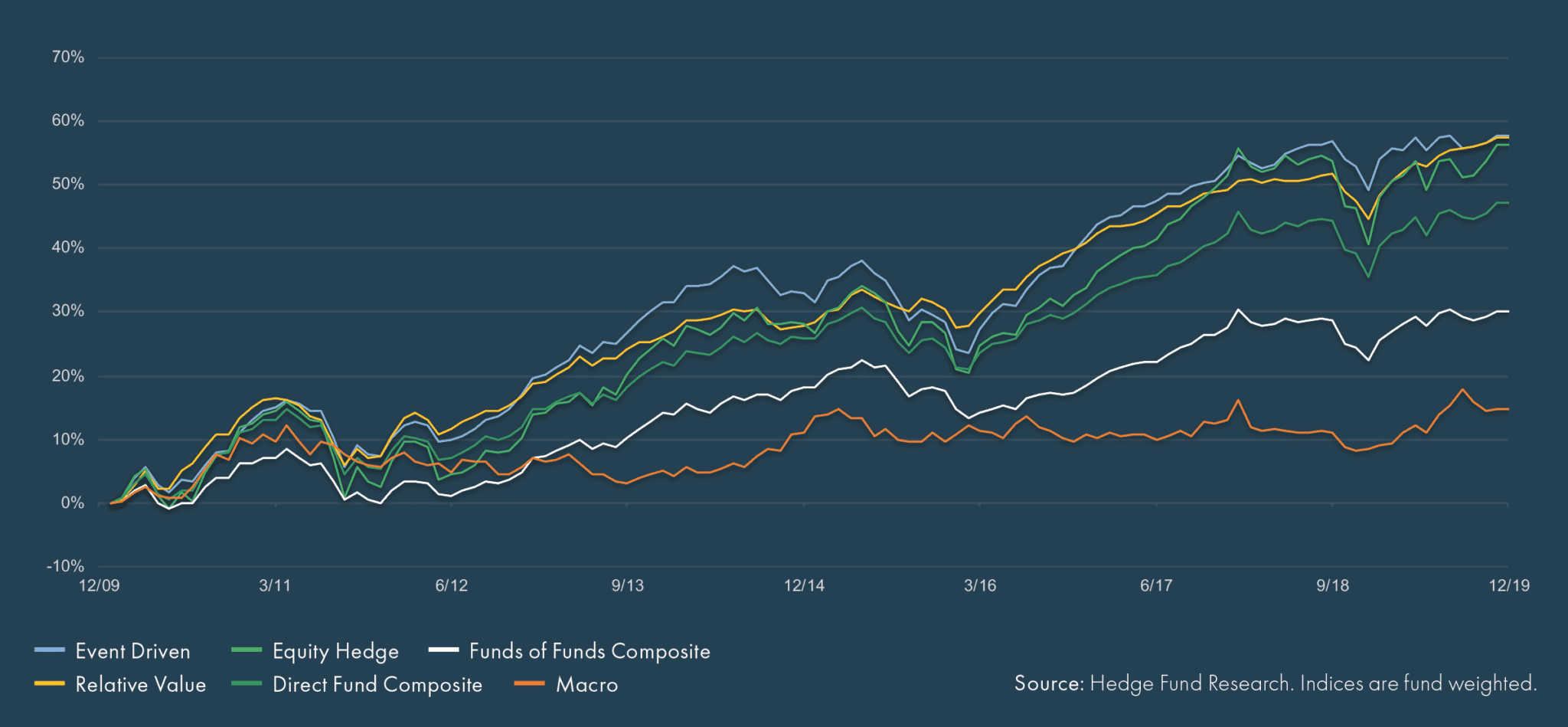

Hedge Fund Cumulative Returns – Trailing 10 Years

Annualized hedge fund returns averaged 2.5% over the last decade, led by Event Driven and Relative Value strategies.

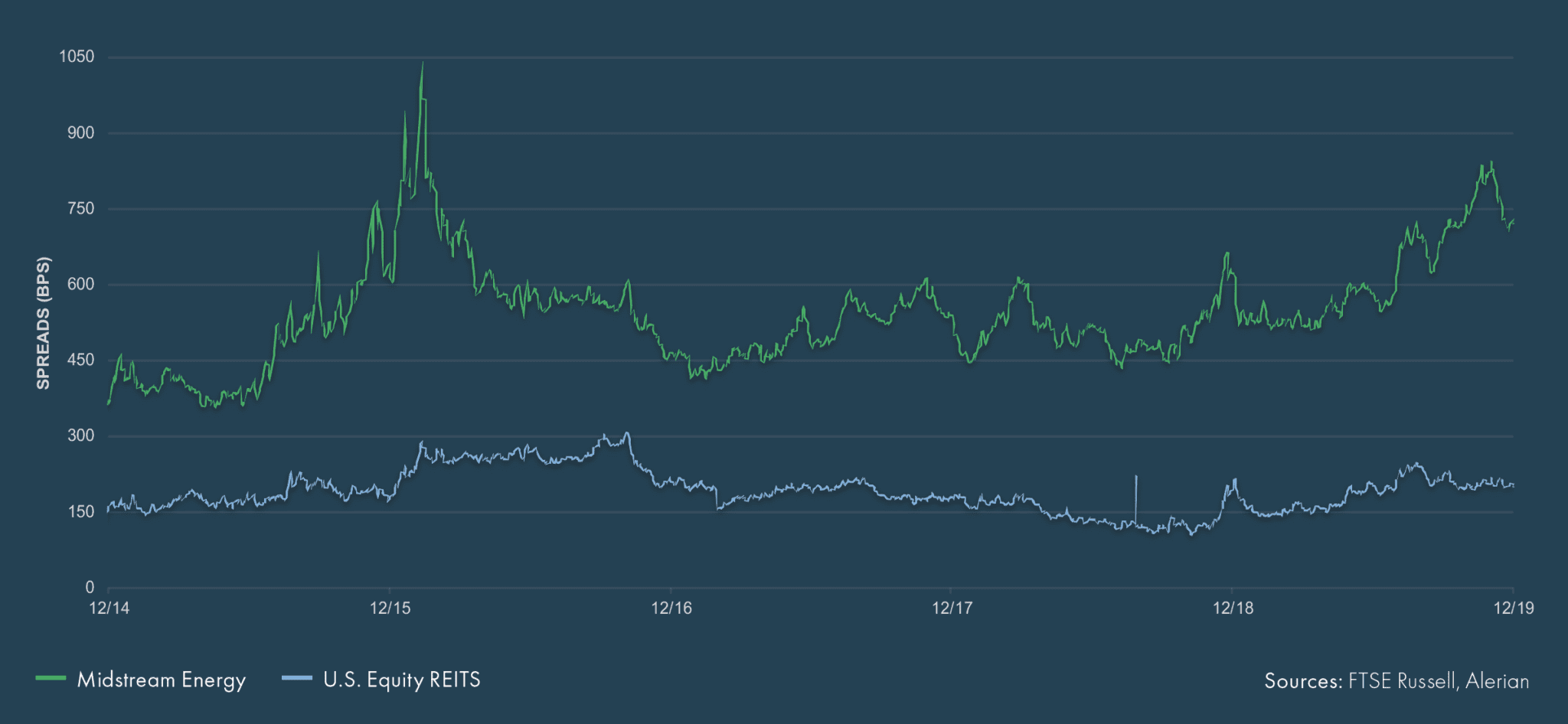

Spreads over 10-Year Treasury

Midstream energy rallied in December as concerns about slowing crude production moderated. U.S. REITs and midstream energy continue to offer a healthy yield advantage over Treasuries

Economic Review

PMI Composites

Despite a modest uptick in the fourth quarter, business activity has slowed since 2018. PMIs below 50 signify a contraction.

U.S. Inflation

Core CPI continues to trend above 2.0%, but the Fed’s preferred measure, Core PCE, remains below target.

Real GDP Growth (YoY %)

EM growth has been strongest over the last decade, largely driven by China. Forecasts across regions for 2020 and 2021 look more dismal.

Monetary Policy Rates

Most central banks had been tightening monetary policy since 2016, but that trend is now turning back to easing.

Financial Market Performance

Periods greater than one year are annualized. All returns are in U.S. dollar terms.

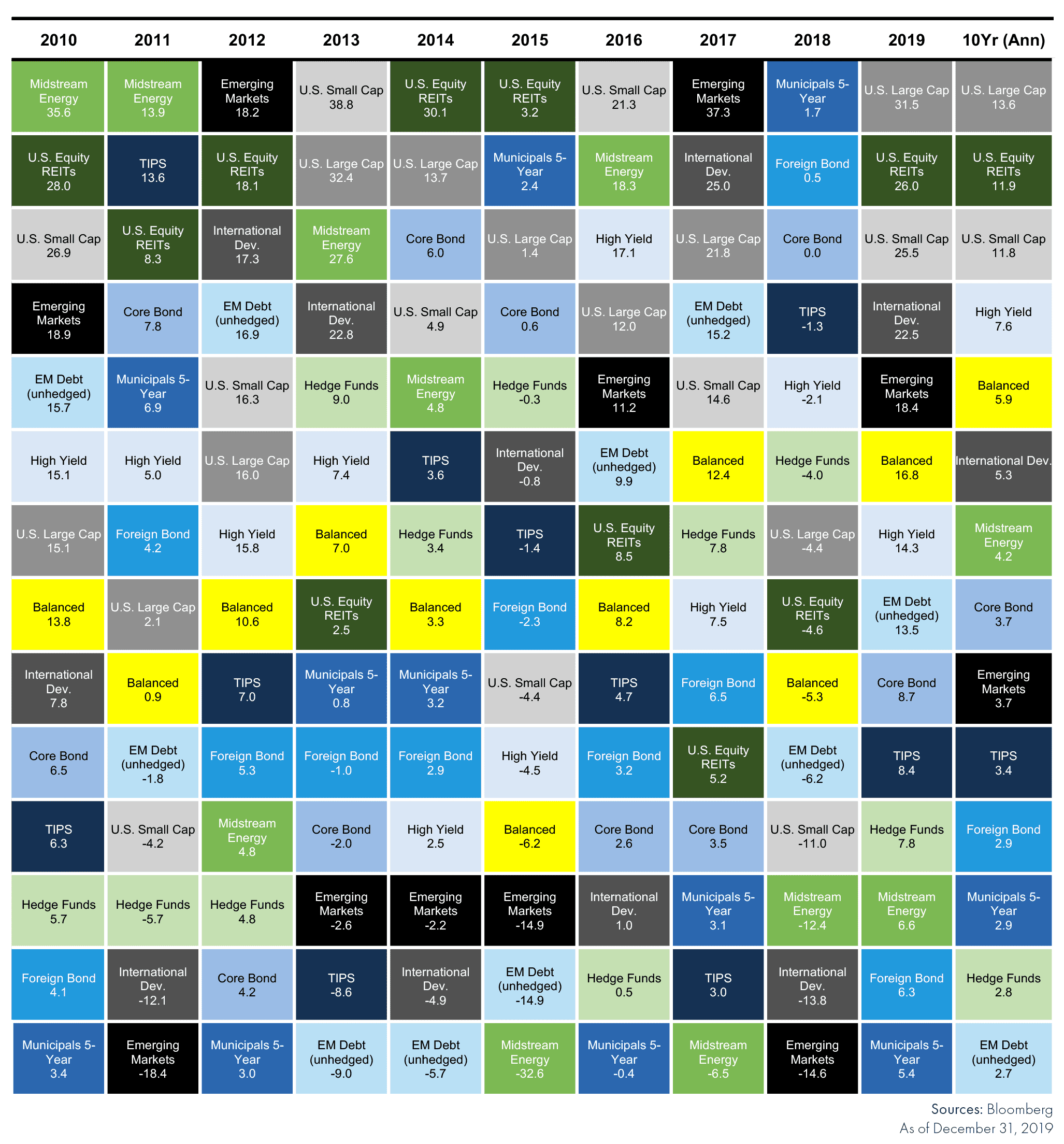

Why Diversify?

Year-by-Year Performance Rankings of Asset Classes

These materials have been prepared for informational purposes only based on materials deemed reliable, but the accuracy of which has not been verified. Past performance is not indicative of future returns. These materials do not constitute an offer or recommendation to buy or sell securities, and do not take into consideration your circumstances, financial or otherwise. You should consult with an appropriately credentialed investment professional before making any investment decision.