By Bill Hornbarger, Moneta CIO

“Individuals who cannot master their emotions are ill-suited to profit from the investment process.”

-Benjamin Graham, Father of Value Investing

A colleague recently asked me, “What’s the most important change or innovation I’ve seen in the financial industry during my career?”

I had a front row seat to the Crash of 1987, the Tech Wreck and the Global Financial Crisis. I remember the concept of portfolio insurance, the decimalization of equity trading, the proliferation of derivatives and securitization, and the rise of exchange-traded funds. You can also add day trading, Bitcoin, retail structured products and collateralized debt obligations. Along the way, terms such as hedge funds, quantitative easing and the Fed’s “dot plot” entered the common lexicon when discussing capital markets.

All of these technology-driven changes made important impacts (both positive and negative) on the markets and the infrastructure supporting them. However, for the individual investor, the single most impactful change during the past 30 years has been the evolution of how – and how frequently – investors receive financial information.

In the 1987 movie, “Wall Street,” Charlie Sheen’s Bud Fox and Michael Douglas’ Gordon Gekko used a Quotron machine for stock quotes. The Quotron was a dedicated terminal with green print on a black background that one could punch a ticker symbol into and receive a stock quote. These machines were typically found only in the offices of financial services firms and offered very basic information: bid, offer, last price and volume. In the late 1980’s, most offices still had a ticker tape for more detailed information. Individual investors relied on the nightly news for business news and the next day’s newspaper for stock and mutual fund quotes.

By the early 1990’s, an information revolution was under way. The use of the internet expanded rapidly and cable-originated live television became more widely available. Dedicated financial news sites and programs became more prevalent. CNBC, which launched in 1989 and is now seemingly in homes and businesses worldwide, both in broadcast and website form 24/7. This is just one of a number of current and past financial news providers competing for viewers and ad revenue.

Investors can now access financial news via the internet and social media platforms in real time, see instant analysis, check a stock quote and even trade – all from their smartphone. Having this capability is one thing, but using it – and, in some cases, using it frequently – is something else entirely.

The role of a financial advisor is to help his or her clients reach their financial goals. Most of those goals are long term in nature: saving money for children’s and grandchildren’s educational needs or saving money for retirement, for example. There are multiple ways to meet those goals from an investment perspective, but choosing a path and sticking with it in a disciplined manner is one of the keys to success.

During periods of heightened uncertainty, investors often turn to the financial media for insights into what is happening and how to position or reposition their portfolios. While these commentators make an interesting case, they often provide little value for long-term, goal-oriented investors. Sometimes, they can even influence investors into short-term decisions that run counter to their long-term goals.

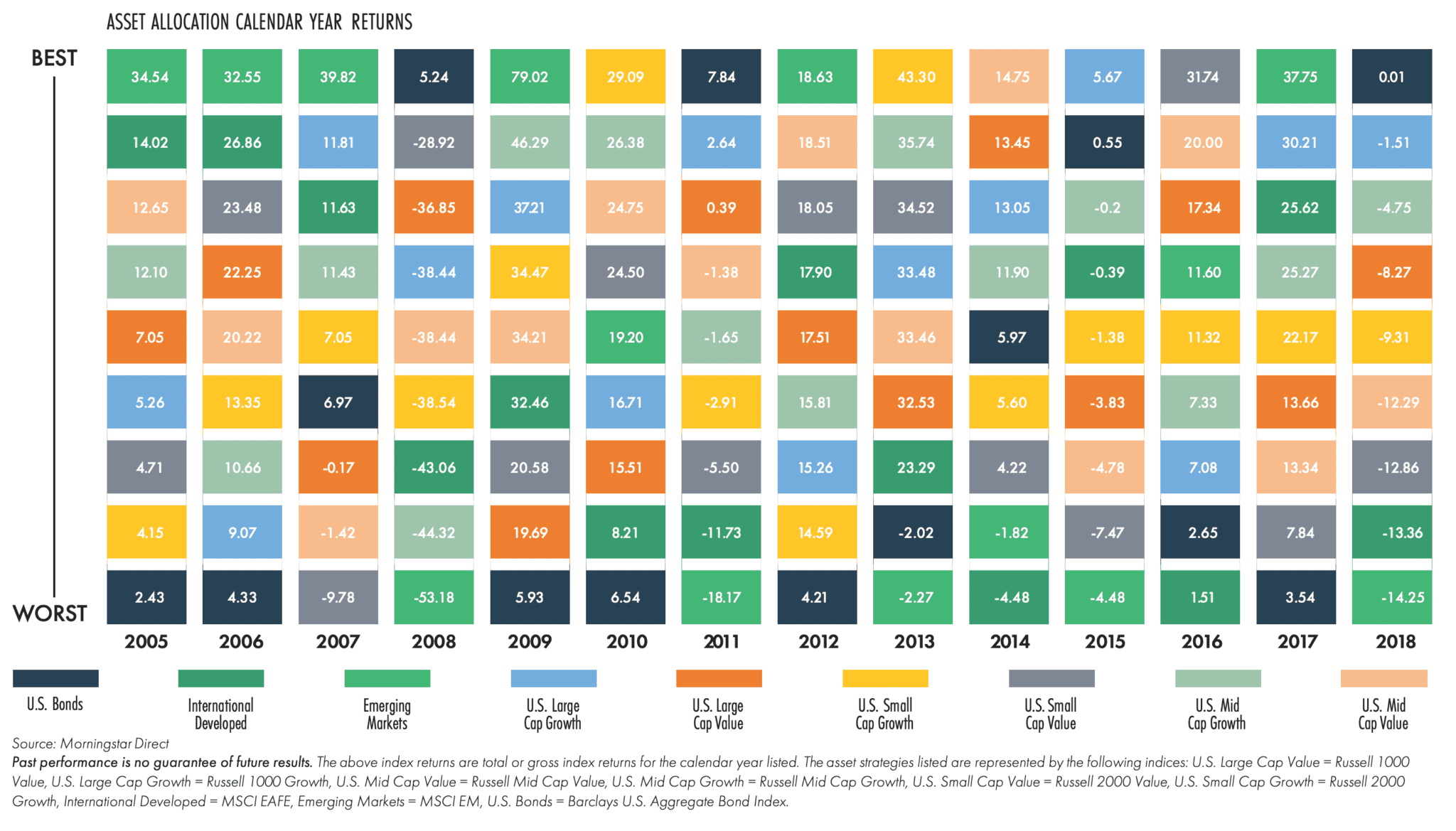

In the short run, the direction of interest rates or the level of the stock market are unknowable and uncontrollable. Focusing too much time and energy on these variables can be counterproductive. Instead, we believe investors are better served by having an open and candid conversation with themselves and their financial advisor on topics such as knowing their true time horizon, risk tolerance and realistic return expectations – and then building a diversified portfolio consistent with them. Building long-term wealth requires counter-emotional investment decisions and being resistant to the panic and euphoria that the financial media can create with its minute-by-minute analysis and advice.

© 2019 Moneta Group Investment Advisors, LLC. All rights reserved. These materials were prepared for informational purposes only. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. Past performance is not indicative of future returns. These materials do not take into consideration your personal circumstances, financial or otherwise.