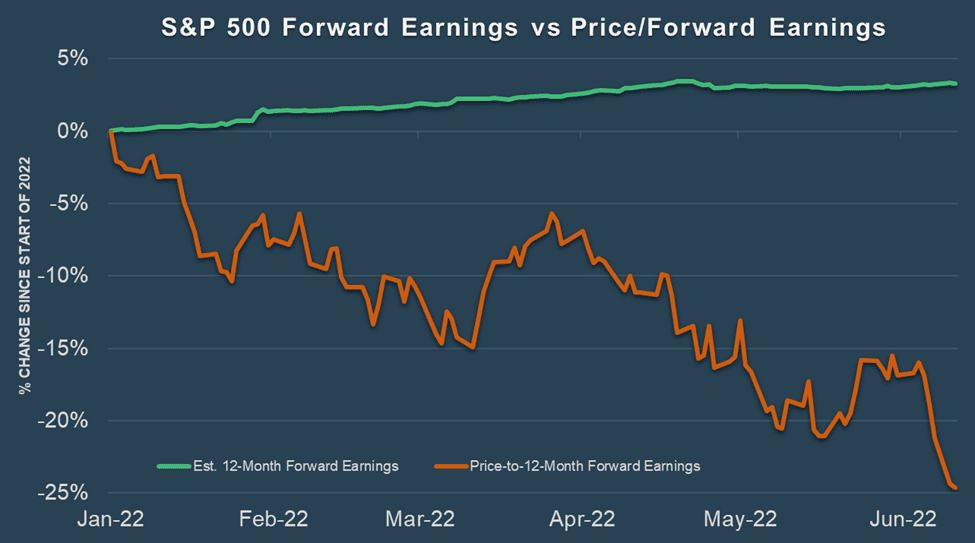

Aoifinn Devitt, MBA | Chief Investment Officer Chris Kamykowski, CFA, CFP® | Head of Investment Strategy and Research After hesitating for months around whether inflation was transitory and to what extent, the US Federal Reserve has “taken the gloves off.” By raising rates today by 75 bps (the largest single increase since 1994) the Fed indicated it is committed to addressing persistently high inflation via monetary policy. In straying from its earlier commitment to 50 bps at this meeting, it responded to inflation that became stubbornly high – as well as “sticky” – and generally heeded the growing rallying cry by investors to do more, faster. The problem is that monetary policy is not a precise instrument when it comes to fighting inflation. Inflation is driven by both demand and supply, so factors choking off economic activity through higher rates can only affect part of it. Much of the current inflation is a result of supply-side increases such as input costs and the cost of energy in particular. Furthermore, the consumer (a key component of demand) is still artificially propped up by the overhang of Covid-induced excesses, such as occasional windfalls in the form of stimulus payments, enhanced unemployment benefits, and excess savings that occurred when travel and other services were curtailed. This “overhang” might now be seen as pent-up demand, whether for “revenge tourism” or other services. No matter how much the Fed wishes to tame the consumer through interest rate hikes, perhaps that horse has bolted. Maybe after two years of Covid restrictions, the consumer cannot – at least for a spell – be tamed. When we think about the Fed’s mission, we might think in terms of a journey and a destination. What is the destination? Clearly the Fed – and indeed any central bank – is aiming not only for lower actual inflation prints, but also lower inflation expectations. If consumers expect inflation to remain high, this may fuel a “buy now” mentality by consumers, which only exacerbates the trends in prices. How they get there – the “journey” – is now clearly diverging around the world. A central bank may – as is the case with the ECB – delay action with rates given flailing economic activity across the Eurozone. On the other hand, a central bank may operate with clarity of purpose (like the Bank of England) to address potential hazards with an unflinching approach to raising rates month on month. Based on the latest Fed announcement today, the Fed’s actions are more akin to the Bank of England. They are perhaps keen to avoid the “gradualist” approach to curtailing inflation that stymied the Fed for most of the 1970s. This only ended when Paul Volcker took charge and made crushing inflation and inflation expectations, THE priority. The guide for addressing persistently high inflation is in the Fed’s hands. Luckily, elevated inflation is a fairly recent nuisance versus the multiple years of double-digit inflation seen in the 1970s. The Fed now must decide what speed to take on its journey to improve its chances of reaching its destination sooner. Move too slow and it faces the risk of inflation becoming unhinged and stagflation growing in possibility; move too fast and it faces the risk of driving the economy into a deep recession. For all these reasons, we are wary of expecting central bank policy to be any kind of silver bullet for today’s market strains. Therefore, as we navigate markets today, we are taking stock of the rapid information discovery that it is allowing. The swift correction in valuations has taken Price/Earnings multiples closer to historic averages while earnings have stayed relatively stable.

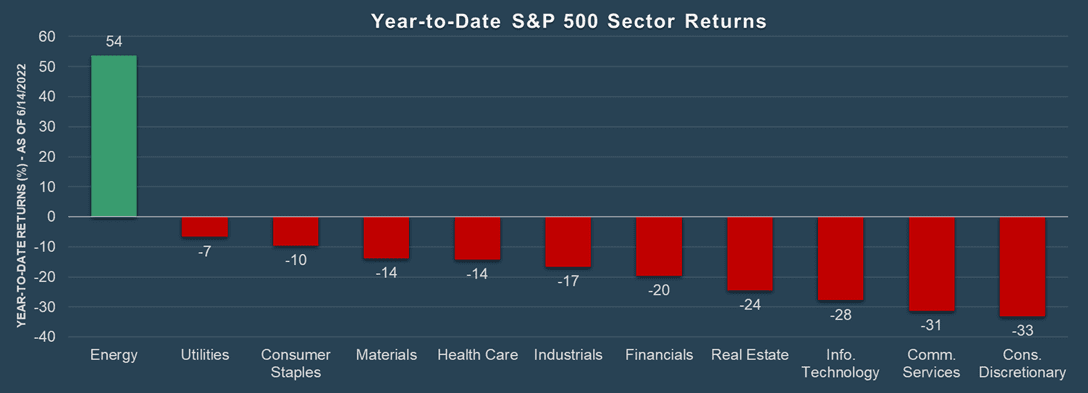

We are also focusing on maintaining portfolio breadth; while the overall stock market as expressed by the S&P is now in a bear market (defined as down more than 20% from its peak), the pain has been quite sector-specific and not universally felt. For example, sectors such as financials, industrials, health care, materials, consumer staples, and utilities – while weak – have been less weak than consumer discretionary and technology stocks, which have dominated the sell-off.

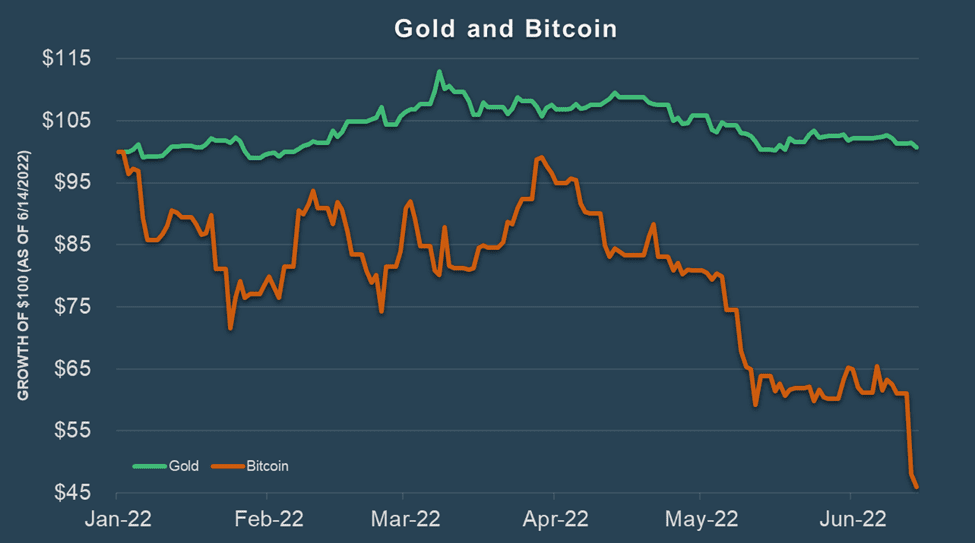

This is why we maintain a balance between value and growth sectors, and a blend of passive and active solutions so that when dispersions in sectors and stocks emerge, there is a higher likelihood of taking advantage of them through active stock-picking. We are also witnessing the true behavior of dazzling objects – old and new. Gold is the original shiny new portfolio object as it was expected to behave as an inflation hedge and diversifier in a portfolio; yet, it has been an abject disappointment year-to-date despite the rising inflation indicators. Similarly, the new-fangled shiny object of cryptocurrency – which was expected to behave as an inflation hedge, portfolio diversifier and return enhancer – has tumbled amid the recent volatility and delivered on none of those expectations.

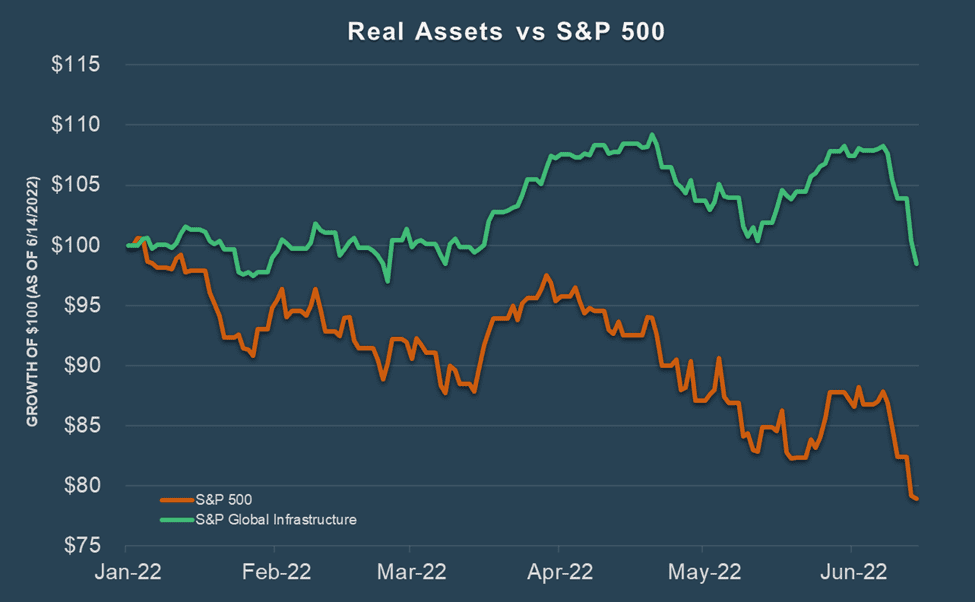

The “old faithfuls” in terms of inflation protection – real estate, infrastructure and real assets – are reeling somewhat from the current shocks, but still protecting capital relative to mainstream markets.

During periods of extreme volatility like this, we try not to get too focused on technical levels – historic market support, for instance – as these have only limited value, like guard rails on a highway. Just as a tractor-trailer can plow through the guardrails, an unprecedented confluence of risk factors such as what markets face today may push markets outside their traditional guardrails. We focus instead on what we do know: labor markets remain strong, consumer spending is robust despite falling confidence levels, and this spending is supporting company margins. We know innovation is still rife and can often thrive amid a market upset. We know the focus on energy security will drive investment in renewable energy sources, and that Covid vaccine development will herald a new era of faster-paced drug development. A well-diversified portfolio will help investors stay the course.

Definitions

- Forward Earnings: Index estimated earnings for next fiscal year based on the best estimate for each member.

- Price-to-Forward Earnings: Current index price level vs estimated earnings for next fiscal year based on the best estimate for each member.

- The S&P Sector and Industry Indices represent sub-sets of the S&P 500 index and measure segments of the U.S. stock market as defined by GICS®.

- LBMA Gold Price is administered independently by ICE Benchmark Administration and utilizes its auction platform on which the LBMA Gold Price is calculated. Daily auctions are held in London twice a day and final auction prices are posted in US Dollars.

- CoinShares Physical Bitcoin (BITC) is a physically backed Exchange Traded Product. BITC trades on a regulated exchange, can be bought and sold like an equity, and provide direct exposure to the price of Bitcoin.

- The S&P 500 Index is a free-float capitalization-weighted index of the prices of 500 large-cap common stocks actively traded in the United States.

- The S&P Global Infrastructure Index provides liquid and tradable exposure to 75 companies from around the world that represent the listed infrastructure universe. To create diversified exposure across the global listed infrastructure market, the index has balanced weights across three distinct infrastructure clusters: Utilities, Transportation, and Energy.

Disclosures © 2022 Moneta Group Investment Advisors, LLC. All rights reserved. These materials were prepared for informational purposes only based on materials deemed reliable, but the accuracy of which has not been verified. Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index and/or Style returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. You cannot invest directly in an index. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.