Lucas Kulma – Advisor

Following roughly a year of debate about whether it would prove transitory or lasting, inflation looks relatively robust, regardless of how it’s measured—CPI, core CPI, PCE, PPI, etc. Nor is an official measure especially required to see prices rising across many staple categories, including food, energy, clothing, cars, etc. The questions, then, are how to approach the current inflationary reality and how to plan and position for the range of possible future realities.

The most crucial step in the immediate term is putting the current inflationary environment in the appropriate historical context. Past is rarely prologue, but it can offer some valuable insights into the range of possible outcomes when similar conditions have historically prevailed. Today’s confluence of several factors—high energy prices amid geopolitical tensions, rising inflation, and moderating or sluggish economic growth—makes it tempting to draw parallels to the 1970s, when an oil embargo resulted in gas station queues and “stagflation” entered the popular financial lexicon. But today’s reality doesn’t reflect the 1970s (and vice versa).

For one thing, inflation today has spiked much faster than in the 1970s—likely thanks primarily to the combination of pandemic-related economic shutdowns and Russia’s February invasion of Ukraine, both of which have meaningfully impaired global supply chains. The widespread belief that rising prices are primarily a supply shock (prices rising mainly because of supply related issues), as opposed to a demand shock (prices rising mostly because demand is way up), is a cornerstone of the argument that this inflationary period will prove relatively transitory (though clearly, the definition of transitory is key here).

The unemployment rate is the other dramatic difference between now and the 1970s—when unemployment was high and likely helped fuel stagflation. In contrast, low unemployment today may contribute to inflation as highly sought workers demand higher wages, introducing the possibility for a wage-price spiral—and turning all eyes to the Federal Reserve, which has the dual responsibility of reining in inflation while maintaining relatively full employment levels.

The Fed has stated it will aggressively raise interest rates in coming quarters to attempt to bring inflation under control. And presumably, with unemployment historically low, it has the breathing room concerning the second half of its mandate. But the Fed’s pronouncement has prompted concerns about what rising interest rates will do to economic growth, as higher rates expect to choke off economic activity as borrowing costs rise eventually. Here, too, some historical perspective is warranted. Interest rates remain historically low at potentially elevated levels in coming quarters. They’re just barely positive when indexed for inflation—hardly reminiscent of 1980s levels.

Whether and for how long inflation will persist and the extent to which the Fed will successfully tame it is to be determined. But one thing history shows is companies have typically adjusted successfully to economic reality. We saw this most recently during the pandemic, when many companies were remarkably nimble and pivoted their businesses in ways that allowed them to operate as fully as possible, even in a heavily restricted and limited environment. To conclude that this time will prove different—that companies won’t successfully adjust to navigating supply chain concerns, employment challenges, rising prices, etc.—is to take the opposite side of history.

With inflation, the current reality, then, and how long it will persist is unknowable; the question is how best to prepare for and weather the period ahead. Critical is, first, taking stock of your financial reality with respect to your mortgage and your equity, alternatives, bond, and cash allocations, and second, devising a plan.

For many, a mortgage is the most significant entry on the liabilities side of their balance sheet. But during inflationary environments (and assuming a fixed-rate mortgage), a mortgage becomes something of an asset given you’re making fixed payments with dollars that, all else equal, are worth less. On the flip side, your ongoing mortgage payments build equity in a tangible asset that should appreciate over time. In this sense, owning a home can provide a helpful hedge against inflation—you own an asset that is likely to increase in value while paying gradually less for it.

It’s also advisable to evaluate your portfolio’s current asset allocation—i.e., its mix of equities, alternatives, bonds, and cash. Year to date, equities are inarguably struggling—as of this writing, the S&P 500 Index is down roughly 20%, the threshold commonly used to define a bear market. Historically, though, equities tend to fare well in inflationary (though not hyperinflationary) environments. If inflation is likely to remain high over the medium- to long-term, increasing equity exposure can help shield a portfolio from value erosion. Stocks’ long-term returns can help ensure the portfolio’s value at least keeps up with—and possibly exceeds—the inflation rate.

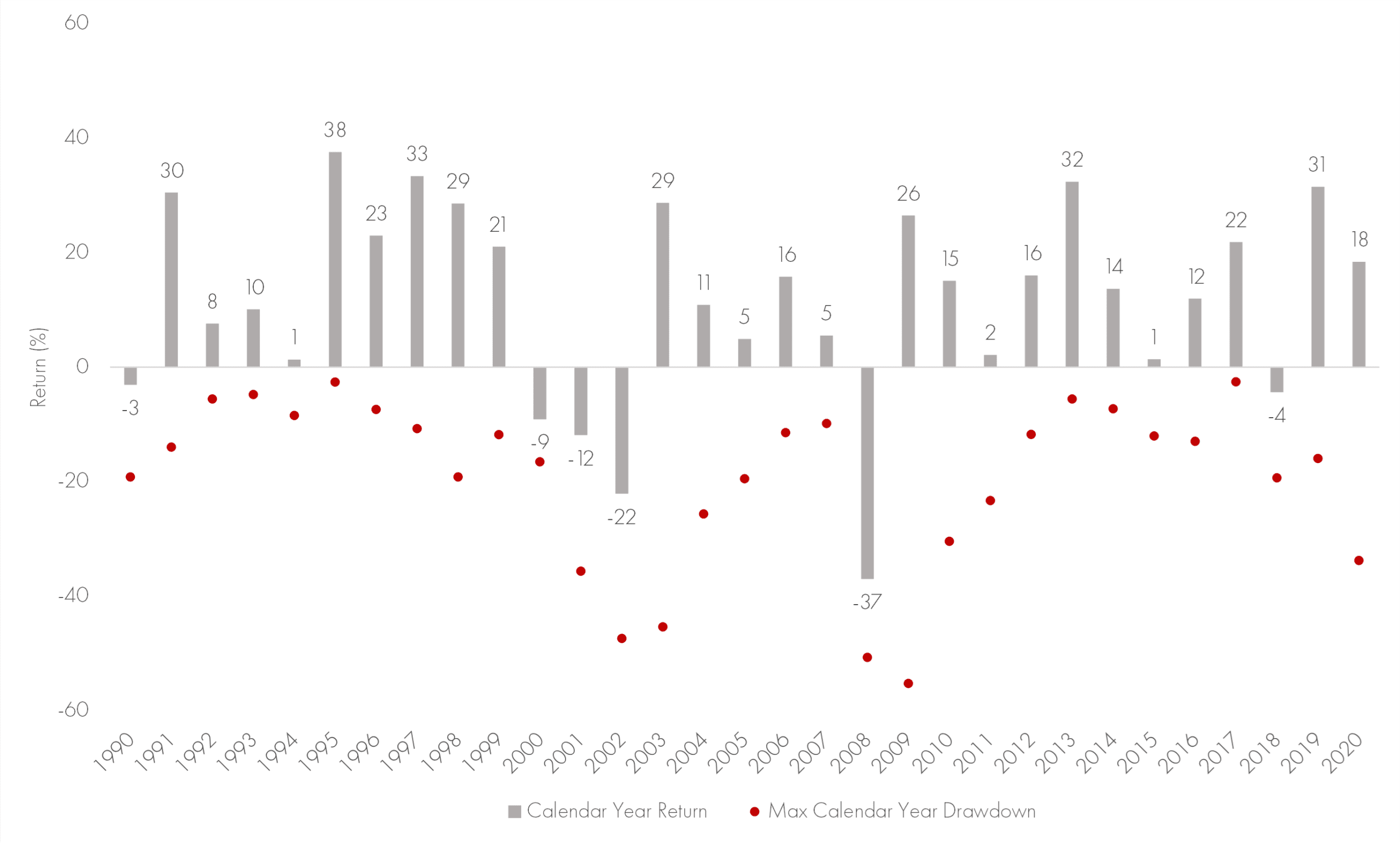

Amid a near-term equity market downturn, it can be challenging to lean into equities—but it’s worth noting that five months of market returns are hardly indicative (or determinative) of future performance. Further, 10% or 20% pullbacks are more common than we typically recall (Exhibit 1). This is particularly true against the post-2009 market backdrop—a period marked by a relatively uninterrupted bull market that makes it easy to forget volatility is much more the norm than smooth, positive returns.

Exhibit 1: Calendar-Year Equity Drawdowns

Source: Morningstar as of December 31,2020; S&P 500 TR index. You cannot invest directly in an index. See important disclosures at the end of this article.

Maintaining exposure to alternative investments—broadly, any investments that aren’t equities or bonds, including commodities, infrastructure, private capital, and more—can help hedge against inflation because these assets’ returns are typically relatively uncorrelated to equities and bonds’ returns. Alternatives also tend not to be entirely subject to the economy’s or markets’ whims, so exposure to them can provide valuable diversification.

A sensible approach to bond allocation is also crucial as inflation persists. Our recommended approach is bond laddering—purchasing bonds of different maturities over time and holding them to maturity. In a rising-rate environment, principal from maturing bonds can be reinvested in higher-rate replacements. Over time, such an approach should yield higher overall returns on the portfolio’s bond allocation while also offering the ongoing benefits of diversification relative to the portfolio’s equity allocation.

With respect to cash, it may be worth considering drawing your balance down and reallocating some money to other investments. When inflation is low, the opportunity cost of a sizeable cash balance is relatively low—the interest payments are likely nominal, but there are rarely many attractive, sufficiently liquid alternatives. As inflation rises, so does the opportunity cost of holding cash—other investments often offer more compelling return potential. While equities or other investments may deliver negative near-term returns, cash will almost certainly produce a negative real rate of return in a sufficiently inflationary environment like todays. Reallocating any cash balance over and above an emergency fund (which is always prudent to maintain) can help shield long-term portfolio value.

These recommendations can be counterintuitive—as goods and services get more expensive, instinct can suggest holding onto cash. But the realities of long-term investing are often counterintuitive—Warren Buffett famously urged fear when others are greedy and greed when they’re fearful. And certainly, as markets have declined year to date, it can be hard to consider increasing equity exposure, let alone adjusting your alternatives or bond allocations.

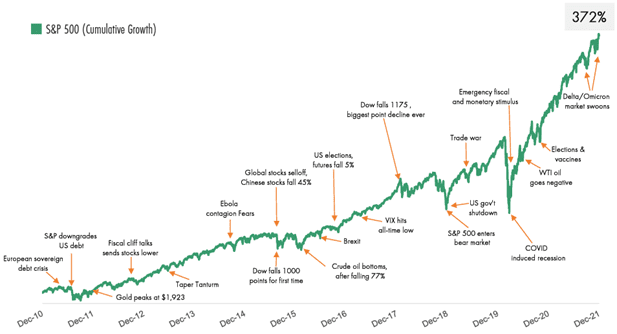

Investors’ nerves are broadly rattled right now for entirely understandable and rational reasons. But historically speaking, there’s always been—and likely always will be—a crisis du jour (Exhibit 2), and markets love to climb the proverbial wall of worry. For those with a sufficiently long-time horizon, it can be an advantageous time to evaluate your current overall financial picture and ensure you’re well-positioned for the period ahead, however it may look.

Exhibit 2: Markets and the Wall of Worry

Source: Morningstar as of December 31, 2021; S&P 500 TR index; Cumulative return. You cannot invest directly in an index. See important disclosures at the end of this article.

© 2022 Moneta Group Investment Advisors, LLC. All rights reserved. These materials were prepared for informational purposes only based on materials deemed reliable, but the accuracy of which has not been verified. Trademarks and copyrights of materials referenced herein are the property of their respective owners. Index and/or Style returns reflect total return, assuming reinvestment of dividends and interest. The returns do not reflect the effect of taxes and/or fees that an investor would incur. Examples contained herein are for illustrative purposes only based on generic assumptions. Given the dynamic nature of the subject matter and the environment in which this communication was written, the information contained herein is subject to change. This is not an offer to sell or buy securities, nor does it represent any specific recommendation. You should consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. You cannot invest directly in an index. Past performance is not indicative of future returns. All investments are subject to a risk of loss. Diversification and strategic asset allocation do not assure profit or protect against loss in declining markets. These materials do not take into consideration your personal circumstances, financial or otherwise.